Independent Financial Intelligence — and what it means for your portfolio, helping investors anticipate risks and seize opportunities.

Mapping the sovereign choreography of AI infrastructure, geopolitics, and capital — revealing the valuation structures shaping crypto, banking, and global financial markets, and translating them into clear, actionable signals for investors.

Truth Cartographer publishes independent financial intelligence focused on systemic incentives, leverage, and powers — showing investors how these forces move markets, reshape valuations, and unlock portfolio opportunities across sectors.

This page displays the latest selection of our 200+ published analyses. New intelligence is added as the global power structures evolve — giving investors timely insights into shifting risks, emerging trends, and actionable opportunities for capital allocation.

Our library of financial intelligence reports contains links to all public articles — each a coordinate in mapping the emerging 21st‑century system of capital and control, decoded for its impact on portfolios, investment strategies, and long‑term positioning for investors. All publications are currently free to read.

[Read our disclaimer and methodology on the About Us page]

Steel’s Role in AI Growth: Demand and Challenges Ahead

In 2025, the steel market performed a surprising 27 percent price rally. The surge was driven by the massive physical requirements of the Artificial Intelligence revolution and aggressive global infrastructure programs.

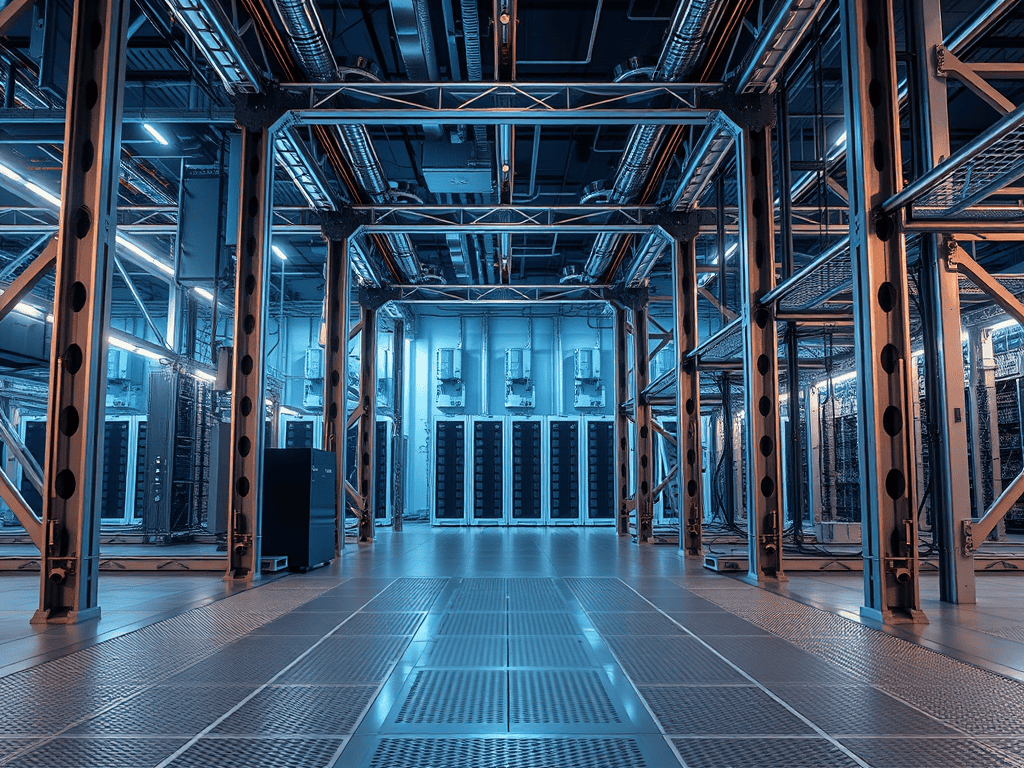

However, unlike the acute supply crunch seen in the copper market, steel faces a unique structural paradox: prices remain elevated despite persistent global overcapacity. The narrative for steel has shifted. It is no longer just a barometer for traditional construction; it has become the physical scaffolding of the digital age. From reinforced data center floors to massive cooling towers and server racks, steel is the indispensable hardware of the Artificial Intelligence era.

The AI Data Center Pivot: Turning Silicon into Steel

The primary driver of the current steel rally is the “Sovereign-Scale” build-out by “hyperscale” cloud providers such as Microsoft, Google, and Amazon.

- Artificial Intelligence Data Center Frames: These massive facilities require specialized steel for structural frames and reinforced flooring to support the immense weight of Graphics Processing Unit clusters.

- Cooling Towers: The thermal intensity of Artificial Intelligence computing demands high-grade steel for sophisticated cooling systems and water distribution infrastructure.

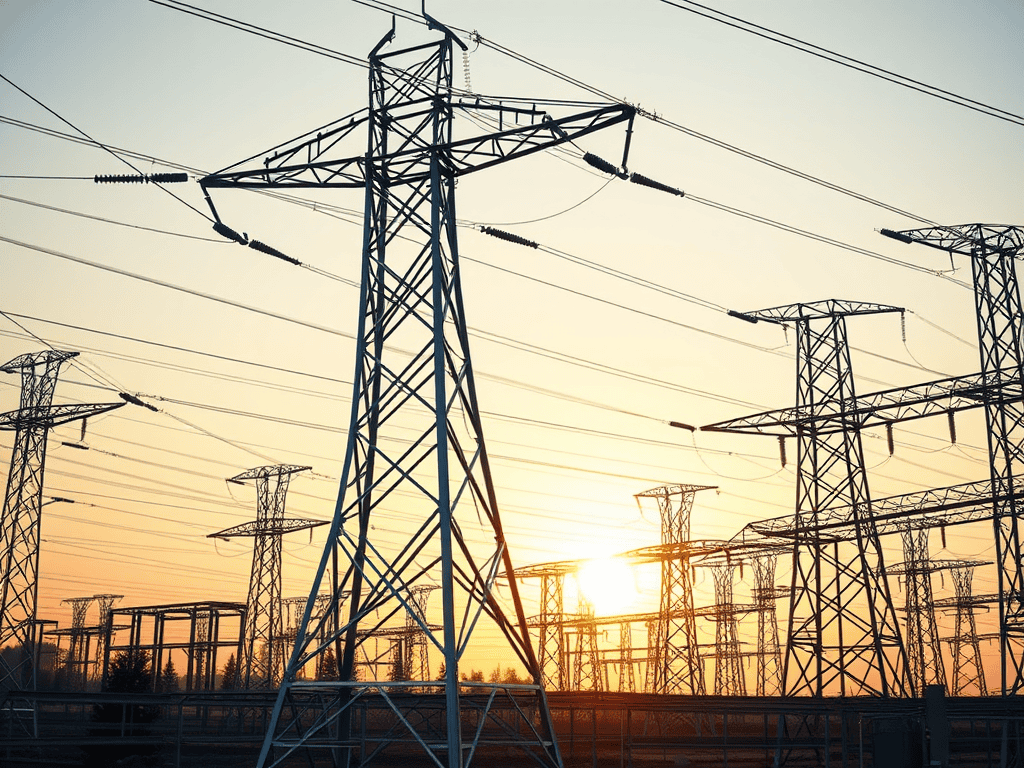

- Energy Infrastructure: Expanding the power grids and building the plants required to feed these data centers adds a secondary layer of intense steel demand.

Steel’s role has evolved from a cyclical industrial metal into the physical backbone of Artificial Intelligence. Every gigawatt of compute capacity added to the global map requires a corresponding tonnage of steel, locking the metal into a long-term growth narrative.

Policy Distortions: The Impact of Tariffs and Energy

Steel prices are currently disconnected from the underlying supply glut due to external friction points that act as a tax on the supply chain.

- The 50 Percent Tariff Wall: The United States administration’s 50 percent tariffs on steel imports have raised costs and disrupted global trade flows. This friction has created regional price imbalances, effectively masking global oversupply within the domestic market.

- Energy Intensity: Steelmaking remains highly energy-intensive. Rising electricity and coal prices in 2025 have squeezed producer margins, limiting supply growth even in regions with excess capacity.

- Decarbonization Pressure: The transition to “Green Steel”—low-carbon production—combined with new carbon taxes has added structural costs that prevent prices from falling to historical levels.

The 2025 rally is partially an optical effect of policy friction. While global supply is abundant, the 50 percent tariffs and high energy costs prevent that supply from dampening prices, creating a “volatility amplifier” for downstream industries.

The Demand Outlook: 2025 vs. 2026

The global steel demand landscape is shifting from a plateau in 2025 toward a modest rebound in 2026.

In 2025, global demand remained flat at approximately 1,749 million tonnes. This stagnation was driven by trade war uncertainty, tariff-induced volatility, and a slowdown in the Chinese property sector.

For 2026, demand is projected to rebound by 1.3 percent, reaching 1,773 million tonnes. This growth will be led by a long-awaited recovery in Europe and aggressive infrastructure expansion across the Global South—specifically in India, Vietnam, Egypt, and Saudi Arabia.

While 2025 was a year of plateau, 2026 signals a return to growth. The trajectory is no longer tied strictly to Chinese housing, but to urbanization in emerging markets and the American technology build-out.

The Supply Reality: Overcapacity vs. Crunch

Unlike the copper market, which faces a structural deficit, the steel market is defined by persistent overcapacity.

- Supply Growth: Global production is rising at 1 to 2 percent annually, consistently outpacing the modest demand rebound.

- The China Factor: China continues to overproduce, flooding international markets with excess supply. This creates a latent drag on prices that only tariffs and trade barriers are currently holding back.

- Emerging Competition: While nations like India and Vietnam are expanding their domestic steel capacity, it is not yet enough to offset the massive oversupply anchored in China.

Steel faces a “Latent Glut.” Supply growth continues to outpace demand, creating a mismatch that keeps margins thin despite high headline prices.

Price Momentum and the Investor Lens

Steel’s price momentum is a result of the collision between infrastructure demand and policy-driven cost increases.

- Short-Term Signal: Prices remain elevated and volatile. The market is pricing the “spectacle” of tariffs and the immediate needs of Artificial Intelligence build-outs while largely ignoring the underlying oversupply.

- Medium-Term Signal: As demand rebounds in 2026, global overcapacity will likely cap any further aggressive rallies. Investors should expect stabilized but “capped” pricing.

- Long-Term Signal: Steel remains a systemic metal, but it will face a permanent margin squeeze. The cost of the green steel transition and the reality of China’s capacity will eventually force a structural consolidation in the industry.

Truth Cartographer readers should decode this as a “Capped Rally.” Steel is the physical backbone of the new era, but the existence of a global glut means upside potential is limited compared to “bottleneck” commodities like copper or silver.

Conclusion

Steel’s 27 percent rally is the market’s response to the physical scaling of Artificial Intelligence, but the structural foundations of the metal remain under pressure.

The systemic signal for 2026 is one of stabilization under a “ceiling.” Artificial Intelligence build-outs provide the floor, while global overcapacity provides the roof. For the investor, the key is recognizing that steel is an infrastructure trade, not a scarcity trade. The supply is waiting just outside the tariff wall.

Further reading:

Understanding the Aluminum Supply Crisis in 2026

In 2025, aluminum performed a 14 percent price rally, signaling its evolution from a common industrial commodity into a systemic electrification metal. While metals like copper manage the “nerves” of the new economy—such as wiring and motors—aluminum has become the “spine.” It is the indispensable material for the high-voltage transmission lines that connect the world’s power plants to the rising campuses of Artificial Intelligence.

This rally is not merely a cyclical fluke; it is the result of a structural collision. Rapid grid expansion and the massive energy appetite of Artificial Intelligence are meeting a supply side that is strictly capped by energy policies and environmental restrictions, particularly in China.

The Primary Drivers: Grid Expansion and the AI Power Draw

Aluminum’s light weight and high conductivity make it the preferred material for long-distance power transmission. In 2025, two primary forces pushed demand beyond historical norms.

- The Global Grid Surge: National electrification programs are being driven by the integration of renewable energy and the expansion of Electric Vehicle charging networks. Together, they have boosted demand for high-capacity transmission lines.

- The AI Power Draw: Artificial Intelligence data centers are uniquely power-hungry. To feed “hyperscaler” campuses, utility providers are increasingly deploying aluminum conductors for high-voltage distribution. This “AI-to-Power” link has transformed aluminum from a construction material into a digital infrastructure asset.

- Capped Chinese Supply: China produces approximately 55 percent of the world’s aluminum. However, in 2025, strict energy consumption caps and environmental rules limited smelter output. Export quotas further tightened global flows, providing a resilient floor for international prices.

Aluminum is now the physical rail through which Artificial Intelligence consumes energy. While volatility persists, the demand from digital infrastructure has created a permanent structural bid for the metal.

The Demand Outlook: Moving from Resilience to Acceleration

The global aluminum market is shifting from a year of resilience in 2025 toward a period of acute structural tightness in 2026.

In 2025, demand growth remained steady at approximately 2 percent. This was sustained by the expansion of solar and wind energy, the continued adoption of Electric Vehicles, and the initial phase of the Artificial Intelligence build-out.

For 2026, demand is projected to accelerate to 3 percent. This stronger growth will be driven by aggressive grid expansion in emerging economies—specifically India, Southeast Asia, and the Middle East (Saudi Arabia and the United Arab Emirates). Additionally, United States and European infrastructure projects are expected to recover as trade policy volatility stabilizes.

The Supply Reality: A Structural Squeeze

Unlike the steel market, which struggles with a glut, the aluminum market is defined by structural tightness. Global primary aluminum output is expected to grow only 1 to 1.5 percent annually into 2026, consistently lagging behind demand.

The Bottleneck Ledger

- China’s Ceiling: With 55 percent of global supply under strict energy caps, Beijing’s ability to respond to price spikes is politically constrained. Export restrictions mean regional shortages are becoming more frequent.

- Marginal Producers: While regions like India and the Middle East are expanding capacity, these incremental gains are insufficient to offset the supply ceiling established by China.

- Smelting Energy Intensity: Aluminum production is among the most energy-intensive industrial processes. Rising global electricity prices have squeezed producer margins, discouraging the construction of new smelting capacity.

- The Green Transition Cost: The shift toward “Green Smelting”—using hydro-powered electricity—raises the capital requirements for new projects, further slowing the pace of expansion.

Aluminum faces a “Structural Squeeze.” Because supply growth cannot keep pace with demand, the market is entering a phase of chronic deficit that prevents prices from returning to pre-AI levels.

Price Momentum and the Investor Lens

Aluminum’s price now reflects the energy policies of the nations that produce it as much as it reflects industrial demand.

- Short-Term Signal: Prices remain elevated and volatile. The market is highly sensitive to energy cost shocks and changes in Chinese export quotas. Traders should expect reactive spikes whenever energy grids face winter or climate stress.

- Medium-Term Signal: Upward momentum is supported by the widening deficit projected for 2026. With demand growth tripling supply growth, the market is entering a phase of upside momentum that has not yet been fully priced into futures curves.

- Long-Term Signal: Aluminum is evolving into a structural bottleneck metal. Its role as the backbone of the electrification and Artificial Intelligence power layers ensures it will trade at a “scarcity premium” compared to traditional base metals.

Truth Cartographer readers should decode this as an “Electrification Bottleneck.” Aluminum has moved beyond its role as a cyclical commodity; it is now a strategic asset anchoring the global transition to a digital, electrified future.

Conclusion

Aluminum’s 14 percent rally is the first chapter of a larger structural shift. As the world builds the assembly lines of intelligence and the grids of renewable energy, aluminum will remain the primary physical constraint.

The systemic signal for 2026 is one of persistent tightness. Artificial Intelligence power needs provide the floor, while China’s energy caps provide the fuse.

Further reading:

Crypto Market Dynamics: Bitcoin vs Altcoins in 2025

The crypto market is no longer a monolithic asset class. As we move through late 2025, a clear structural hierarchy has emerged. Bitcoin is increasingly behaving as a “safe haven” anchor—a stabilizer defined by lower volatility and massive supply lock-up. In contrast, the altcoin market—ranging from Ethereum and Solana to Dogecoin—has become a speculative amplifier, translating market sentiment into sharper, high-beta swings.

This divergence is not accidental. It is rooted in fundamental differences in consensus architecture and how these various assets respond to global liquidity shocks.

The Price Divergence Snapshot

As of December 20, 2025, price data reveals a distinct divergence in daily performance and volatility across the digital asset complex.

- Bitcoin (BTC): Trading near 88,274 dollars with a daily change of +1.37 percent. Signal: Stability and safe-haven anchoring.

- Ethereum (ETH): Trading near 2,985 dollars with a daily change of +2.23 percent. Signal: Moderate upside, driven by Decentralized Finance and Non-Fungible Token adoption.

- Solana (SOL): Trading near 126.37 dollars with a daily change of +2.88 percent. Signal: Higher beta and speculative momentum.

- XRP: Trading near 1.90 dollars with a daily change of +3.41 percent. Signal: Institutional settlement focus with mid-range volatility.

- Cardano (ADA): Trading near 0.37 dollars with a daily change of +3.21 percent. Signal: Mid-tier altcoin with higher relative swings.

- Dogecoin (DOGE): Trading near 0.13 dollars with a daily change of +3.94 percent. Signal: Meme-driven extreme volatility.

Bitcoin currently acts as the market’s primary stabilizer. This reflects its dominance and the fact that 74 percent of its supply is held by immobile, long-term wallets. Altcoins, conversely, are higher-beta assets that offer more upside for speculation but carry significantly higher systemic risk during periods of volatility.

Mining vs. Staking: The Scarcity Ledger

The divergence in price behavior is mirrored by the divergence in consensus mechanisms. How a coin is “minted” dictates its scarcity narrative and its role in an investor’s portfolio.

Mining Scarcity (Proof of Work)

- Assets: Bitcoin, Dogecoin, Litecoin.

- Dynamics: Supply is released via block rewards through energy-intensive computing power.

- Investor Signal: Bitcoin enforces scarcity through its halving schedule, anchoring its role as digital gold. While Dogecoin and Litecoin use mining, their supply dynamics are more inflationary, offering a weaker scarcity narrative than Bitcoin.

Staking Scarcity (Proof of Stake)

- Assets: Ethereum, Solana, Cardano, Polkadot.

- Dynamics: Security comes from locked coins used as collateral, not mining. Rewards are paid to validators.

- Investor Signal: These are ecosystem-driven growth assets. Scarcity comes from “staked supply,” and returns are tied to yields and network adoption. They attract capital seeking growth, but their volatility remains higher than Bitcoin.

Pre-Mined Models

- Assets: XRP.

- Dynamics: Fixed supply at launch, with distribution controlled by a central foundation or consortium.

- Investor Signal: Adoption depends on institutional partnerships and settlement rails, such as Central Bank Digital Currency pilots. Trust is rooted in corporate governance rather than algorithmic scarcity.

Correlation vs. Volatility: The Sentiment Loop

Even though altcoins utilize different consensus models, their pricing remains sentiment-coupled to Bitcoin. However, the magnitude of their response is the decisive differentiator.

- Bitcoin Sets the Tone: As the dominant anchor, Bitcoin’s moves dictate the overall market mood. When Bitcoin rises or falls, altcoins rarely diverge in trend.

- The Volatility Index: The real divergence is magnitude. Altcoins swing harder across the board. While Ethereum is relatively moderate, Solana and Cardano are sharp, and Dogecoin remains extreme.

- Investor Implication: Bitcoin provides directional clarity, while altcoins amplify the move. For an investor, owning altcoins is effectively a leveraged bet on Bitcoin sentiment, carrying both higher potential reward and catastrophic downside risk.

In the crypto hierarchy, there is correlation in direction but divergence in volatility. Bitcoin is the compass; altcoins are the high-beta extensions of that compass.

The Liquidity Shock: How the Vacuum Cascades

The recent Bank of Japan rate hike has provided a significant challenge for this hierarchy. The end of the “yen carry trade”—as analyzed in our master guide, Yen Carry Trade: The End of Free Money—has added a severe stress test to the system.

When a liquidity vacuum is created, the capital drain cascades across the entire complex:

- Bitcoin Absorption: As the anchor, Bitcoin absorbs the initial shock. While it faces downward pressure, its scarcity and immobile supply cushion the impact.

- Altcoin Amplification: Altcoins mirror Bitcoin’s downward move but with amplified volatility. Their internal fundamentals, such as staking yields or meme culture, do not shield them from the macro vacuum; instead, their thinner liquidity accelerates their decline.

Bitcoin is the anchor asset in times of liquidity stress, while altcoins act as the amplifiers of liquidity shocks. The systemic signal is clear: in a deleveraging event, altcoins will always bleed faster and deeper than the anchor.

Conclusion

To navigate this era, investors must distinguish between the stability of the anchor and the magnification of the amplifier. Bitcoin’s scarcity anchors the floor, while altcoin volatility defines the ceiling.

In a world of central bank liquidity mop-ups, the anchor survives the vacuum, while the amplifier feels the squeeze.

Further reading:

Bitcoin: Scarcity Meets Liquidity in 2025

Summary

- Bitcoin’s programmed supply squeeze meets global central bank tightening, reshaping price discovery.

- Japan’s rate hike ends decades of cheap yen funding, forcing deleveraging and a $140B Bitcoin wipeout.

- 28% of U.S. adults now own crypto, while 74% of Bitcoin supply sits immobile with long‑term holders.

- Despite thousands of altcoins, Bitcoin remains the anchor — sovereign collateral for digital portfolios.

Bitcoin’s value has always rested on its programmed scarcity. But as 2025 ends, that scarcity is colliding with a new reality: global central banks are tightening liquidity.

The Bank of Japan’s historic rate hike ended decades of cheap yen funding. Borrowing costs have jumped, making it far more expensive to buy Bitcoin with leverage.

Two Forces in Play

Bitcoin’s price discovery is now shaped by two opposing forces:

- Scarcity (bullish): Only about 700,000 new BTC will be mined over the next six years, tightening supply.

- Liquidity (bearish): The end of the yen carry trade forces global deleveraging. Analysts warn of a 20–30% short‑term decline as liquidity stress outweighs scarcity.

Scarcity is the oxygen for long‑term growth. Liquidity is the atmospheric pressure. Without pressure, oxygen alone can’t sustain the price.

The BoJ Vacuum

On December 19, 2025, Japan raised rates to 0.75%, its highest in 30 years. This move didn’t just raise borrowing costs — it pulled the plug on leveraged risk trades worldwide.

- Deleveraging: Hedge funds unwound positions in equities and crypto.

- Settlement shock: Bitcoin lost $140B in market cap as investors rushed to repay yen loans.

- Fed limits: U.S. rate cuts may ease conditions, but they cannot replicate Japan’s negative‑rate era.

Adoption vs. Lock‑Up

Even as liquidity tightens, Bitcoin’s ownership structure is becoming more resilient:

- Mainstream adoption: About 28% of U.S. adults (65M people) now own digital assets, comparable to stock market participation.

- Supply immobility: 74% of Bitcoin’s circulating supply hasn’t moved in over a year, reducing the liquid float.

This combination creates strong upward demand but also makes the tradable supply extremely sensitive to macro shocks.

Bitcoin as the Anchor

Despite thousands of altcoins, Bitcoin remains the anchor of the crypto market:

- BTC: Held by 70–75% of crypto owners (~45–50M people).

- ETH: Second place at 40–45% (~26–29M people), driven by DeFi and NFTs.

- Altcoins: Solana, Dogecoin, Cardano, and others spread across 25–30%.

For most investors, Bitcoin is no longer speculative. It is “sovereign collateral” — the savings account of digital portfolios.

Conclusion

Bitcoin is caught in a tug‑of‑war: the slow‑burn math of scarcity versus the instant‑fire mechanics of liquidity.

Scarcity and adoption are real. But the capital that funds Bitcoin is no longer free. To navigate 2026, investors must distinguish between the protocol’s long‑term scarcity and the central banks’ short‑term liquidity shocks.

Further reading:

The Great Migration: SEC to CFTC and What It Means for Crypto

By January 2026, the United States Securities and Exchange Commission will enter unprecedented territory. For the first time in the agency’s history, all five commissioners will be Republicans. As noted in a Financial Times analysis by Michelle Leder published in December 2025, titled “The SEC is heading into dangerous territory,” this “monochromatic” tilt risks pushing Wall Street’s primary watchdog into an era of purely partisan oversight.

For the crypto ecosystem, however, this shift is being choreographed as a “Great Migration.” The objective is clear: to move digital assets from the restrictive “securities” cage of the Securities and Exchange Commission into the expansive “commodities” rail governed by the Commodity Futures Trading Commission. This represents more than a mere change in rules; it is a fundamental shift in the grammar of financial legitimacy.

The End of Neutrality: A Partisan Watchdog

The Securities and Exchange Commission has traditionally functioned on a bipartisan model to ensure that investor protection remains a structural constant rather than a political variable. The shift to an entirely Republican commission signals three major breaches in that institutional tradition:

- The Partisan Imbalance: A monochromatic board eliminates the “friction of dissent” that has historically safeguarded market confidence and balanced enforcement.

- Politicized Enforcement: Eighteen Republican Attorneys General have already sued the Securities and Exchange Commission for “unconstitutional overreach” regarding digital assets. An all-Republican board is unlikely to contest these claims; it is more likely to surrender jurisdiction entirely.

- The Reputation Risk: Global markets rely on the perception of the Securities and Exchange Commission as an objective referee. If oversight is perceived as a tool for political patronage, the long-term institutional trust in American capital markets may begin to erode.

Securities vs. Commodities: The Fight for “Oxygen”

The core of the Great Migration is the legal classification of tokens. In the current regime, digital assets are often suffocated by the heavy requirements of securities law. The monochromatic Securities and Exchange Commission aims to provide “oxygen” to the sector by reframing tokens as commodities.

The Securities Cage (SEC Oversight)

Under Securities and Exchange Commission oversight, the burden is high. Tokens treated as securities must register, file exhaustive quarterly disclosures, and undergo expensive audits. Furthermore, lawsuits against exchanges for “unregistered securities” have acted as a permanent brake on innovation and listing velocity, resulting in high compliance costs that favor only the most capitalized incumbents.

The Commodities Rail (CFTC Oversight)

In contrast, the Commodity Futures Trading Commission offers a “lighter touch.” Oversight focuses on market integrity—preventing fraud and manipulation—rather than the heavy paperwork of disclosure. Under this logic, crypto is treated like gold or oil: assets that trade on supply and demand mechanics rather than the performance of a centralized management team. This environment allows for rapid listing, higher liquidity, and a lower barrier to entry for new participants.

The Legislative Hinge and Investor Scenarios

While a partisan Securities and Exchange Commission can soften enforcement, permanent clarity requires an act of Congress. The Great Migration currently sits in a state of regulatory limbo, presenting investors with two primary paths.

Scenario A: Commodity Classification (The Bill Passes)

If legislation formally transfers power, investors should expect a structural re-rating of crypto assets as they transition from “illegal securities” to “legitimate commodities.” This would likely trigger massive capital inflows as United States exchanges gain the legal cover to list hundreds of new tokens, supported by codified anti-fraud rules that provide a “floor” of legitimacy for institutional entry.

Scenario B: Lighter Enforcement Only (The Bill Stalls)

If the bill fails, the result is a fragile reprieve. The Securities and Exchange Commission may stop suing firms, but the legal “Sword of Damocles” remains. This could lead to a short-term relief rally that remains vulnerable to the next political cycle. Without statutory changes, the “Wild West” returns, potentially leading to systemic instability and a collapse in long-term confidence.

Commodity classification offers a structural re-rating; lighter enforcement offers only a temporary boost. For the investor, the decisive signal is not the regulator’s silence, but the Congressional vote that makes that silence permanent.

The Reversal Risk: The Pendulum Problem

The greatest danger of a monochromatic commission is that it grants “Rented Legitimacy.” In a system where rules follow a partisan tilt rather than architectural law, the risk is always a violent reversal of the pendulum.

If a future administration returns to a Democratic majority, the Great Migration could be reversed almost overnight. Tokens could be re-labeled as securities, forcing companies that scaled under commodity rules into retroactive compliance or costly market exits.

If legitimacy is granted through proximity to power rather than rule-based compliance, it becomes a liability. Companies scaling in this era must build for “pendulum resilience,” ensuring their architecture can survive a return to stricter securities framing.

Conclusion

The Securities and Exchange Commission is entering dangerous territory not because it is deregulating, but because it is politicizing the ledger. For the citizen-investor, this demands a new forensic discipline:

- Audit the Law, Not the Tone: Softened enforcement is an optic. Only a Congressional bill provides the actual architecture for the Commodity Futures Trading Commission to take control.

- Watch the Attorneys General: The 18 Republican state prosecutors are the vanguard of this shift; their filings serve as lead indicators for federal policy moves.

- Prepare for the Pendulum: Assume that current “commodity oxygen” is a timed release. Build portfolios that can withstand a sudden return to “securities suffocation.”

The monochromatic Securities and Exchange Commission is a signal that the protocol of American finance is drifting from code to power. The Great Migration offers a window of growth, but it is a growth built on a partisan stage. In this environment, the investor must read the choreography before the actors change.

Further reading: