Independent Financial Intelligence — and what it means for your portfolio, helping investors anticipate risks and seize opportunities.

Mapping the sovereign choreography of AI infrastructure, geopolitics, and capital — revealing the valuation structures shaping crypto, banking, and global financial markets, and translating them into clear, actionable signals for investors.

Truth Cartographer publishes independent financial intelligence focused on systemic incentives, leverage, and powers — showing investors how these forces move markets, reshape valuations, and unlock portfolio opportunities across sectors.

This page displays the latest selection of our 200+ published analyses. New intelligence is added as the global power structures evolve — giving investors timely insights into shifting risks, emerging trends, and actionable opportunities for capital allocation.

Our library of financial intelligence reports contains links to all public articles — each a coordinate in mapping the emerging 21st‑century system of capital and control, decoded for its impact on portfolios, investment strategies, and long‑term positioning for investors. All publications are currently free to read.

[Read our disclaimer and methodology on the About Us page]

Equities Hedge, Crypto Dramatizes

In the global theater of finance, there is a fundamental divergence in how different rails process a crisis. Equities internalize risk; crypto dramatizes it.

Institutional markets use a sophisticated choreography of hedging desks, sector rotation, and central-bank optics to pre-discount shocks. In contrast, the crypto market relies on belief as its primary buffer. Because belief is binary, it tends to collapse on contact with reality. This causes a “Realization Price.” It is a structural lag where crypto reacts to the spectacle of a crisis. The reaction happens rather than in response to the policy that precedes it.

The Architecture of Absorption vs. Performance

The split between these two systems involves more than just asset type. It concerns the scaffolding that supports them during a rupture.

- Equities (Structural Flow): Geopolitical shocks are absorbed through institutional choreography. Capital is moved across sectors. Hedges are adjusted in the options market. The risk is neutralized through structure long before the headline fades.

- Crypto (Symbolic Belief): Crypto behaves as a performance of risk. It lacks the sovereign buffers and institutional buyback flows that stabilize traditional markets. What remains is reflexive liquidity—sentiment loops that amplify shocks into cascades.

Crypto doesn’t price in risk; it prices in realization. When the state hedges, equities absorb the impact. When the crowd reacts, crypto fractures.

The Historical Shock Lag

The history of geopolitical ruptures confirms this pattern of symbolic timing. Crypto tends to move only when the optics of a crisis materialize, rather than when the technical risk first appears.

Case Studies in Realization

Regarding the Russia-Ukraine Invasion (February 2022), Bitcoin shed more than 200 billion dollars in market capitalization. This move did not happen as the geopolitical tension built. It occurred only after the optics of Russian tanks crossing the border were broadcast globally.

In terms of China’s Mining Ban (2021), the market experienced a 30 percent collapse. This was not a pre-priced regulatory shift but a panicked reaction to the physical realization of a hash-rate migration.

Most recently, the Trump 2025 Tariff Announcement pulled Bitcoin below 106,000 dollars within hours. The policy had been discussed for months. However, the market only performed the risk when the announcement became a definitive “spectacle.”

Why Crypto Is Prone to Symbolic Burnout

The reason crypto remains so reactive is the absence of structural anchors. In the traditional world, earnings and sovereign backstops act as “gravity” that prevents a total narrative collapse.

- Reflexive Liquidity: In crypto, the exit is always crowded. There is no underlying cash flow to justify “holding the line” during a shock.

- Symbolic Exhaustion: When belief breaks, liquidity vanishes. When belief returns, liquidity lags. This creates cycles of burnout where the market becomes exhausted by its own volatility.

Crypto lacks institutional hedging and sovereign buffers. Without earnings to stabilize a narrative collapse, the market is governed by a choreography of belief that is inherently fragile.

The Investor’s Watchlist—Decoding the Spectacle

To navigate this environment, investors must stop tracking policy and start tracking optics. In the crypto regime, the headline is the settlement.

Key Factors to Monitor

- Geopolitical Optics: Recognize that crypto does not respond to the nuances of policy. It responds to the spectacle of the event. To protect a portfolio, one must price the risk before it becomes a viral headline.

- Liquidity Anchors: Distinguish between tokens with deep stablecoin pairs and custodial backing versus those that are purely speculative. Tokens without buffers are the first to collapse when the belief drains.

- Narrative Saturation: A token or a risk factor starts trending on social media. At that point, it is already “priced in” due to the realization lag. Saturation is a signal of imminent reversal.

- Redemption Logic Audit: Ask what truly redeems the asset. If the answer is “the community” or “the vibes,” the structure is mere scaffolding. It will not survive a liquidity vacuum.

Applying the Equities Matrix to Crypto

For the crypto market to mature, participants must begin rehearsing institutional discipline. The “Equities Matrix” provides a blueprint for surviving the next realization shock.

- Institutional Hedging: Move beyond simple “HODLing” by using stablecoin rotation or inverse ETFs as structural buffers.

- Sector Rotation: During times of conflict, avoid high-beta altcoins. Shift toward infrastructure tokens that have clear utility in compute, storage, and security.

- Protocol Revenue Tracking: Prioritize protocols with visible, on-chain cash flow. This can act as a fundamental floor during a sentiment crash.

- Treasury Health: Audit protocol reserves and burn rates. A strong treasury is the only sovereign buffer a decentralized project can possess.

Conclusion

Crypto’s greatest strength—its ability to democratize unfiltered belief—is also its primary systemic vulnerability. It democratizes speculation but resists the very structures that would allow it to absorb risk.

The only path forward is a hybrid one. Investors must participate in symbolic markets while rehearsing institutional discipline. Crypto needs to hedge before the war. It should rotate before the sanctions. Otherwise, it will remain a market that reacts to the stage rather than one that owns the script.

Further reading:

Humor Became Financial Protocol

Memecoins move faster than sense. They surge, split, and evaporate like shared hallucinations priced by reflex. Traders call it liquidity; the crowd calls it fun. But what’s being rehearsed is velocity without architecture—motion without meaning.

Every chart that spikes upward is a chant in disguise: we believe, we believe. But belief is not a balance sheet. It is a choreography of timing, exit, and digital humor. Memecoins trade like energy bursts in a symbolic reactor. In this regime, value is irrelevant. Velocity is sovereign.

Generational Wealth as Satire

When a trader tweets “this coin will make me rich,” they are not making a financial forecast—they are performing a ritual. Memecoin culture has successfully monetized irony. “Generational wealth” becomes a ritual spell, a joke encoded as a prophecy.

If the joke is repeated enough times, it becomes a liquidity pool. In the meme era, the claim is the collateral. The market no longer asks what an asset is. It asks how many people are willing to believe in it simultaneously.

The Utility Mirage—Spectacle Over Substance

As memecoins stumble toward institutional legitimacy, they adopt the rituals of respectability: staking, governance, and Non-Fungible Token (NFT) integrations. These are branded as “utility.”

However, this utility is almost entirely decorative. It is an act of theatrical seriousness draped over something fundamentally absurd. Utility is no longer functional; it is insurance against disbelief. The market tolerates the masquerade because narrative endurance now outranks engineering depth. A protocol that can survive a 90% drawdown through humor is more “resilient” in the symbolic economy. It is more resilient than a technically perfect but boring alternative.

Humor performs the same function as encryption—it protects belief from collapse. When a coin fails, the community laughs. That laughter isn’t resignation; it’s resilience. Absurdity becomes armor, converting loss into lore. This is the genius of memecoins: they turn failure into culture.

Institutional Irony—From Rebellion to Index

What began as a rebellion against the “serious” financial order has matured into a sentiment index. The fringe has become the barometer.

- Sentiment Correlation: Major hedge funds now monitor dog and frog tokens for sentiment correlation.

- Back-Testing Volatility: Institutions that once mocked “dog money” now back-test its volatility to forecast broader market risk appetite.

- Narrative Control: Memecoins are not bubbles in the traditional sense. They are experiments in narrative control, proving that whoever controls the meme controls the capital flow.

Humor is not branding; it is the blockchain of belief. In the symbolic economy, posting is minting, and laughing is verifying.

The Investor’s Quiet Conversion

The role of the investor has fundamentally changed. Investors are no longer auditors of value; they are interpreters of narrative.

In traditional markets, research meant reading financials and auditing balance sheets. In memecoin markets, research means decoding virality and mapping the topology of digital belief. The serious investor must become a semiotician—someone who can distinguish between a dying joke and a rising myth. The memecoin trader is both a gambler and an anthropologist, betting on the staying power of a collective emotion.

The Rise of Memetic Capitalism

We are witnessing a structural shift in the nature of capital itself.

- Industrial Capitalism was built on steel and physical production.

- Financial Capitalism was built on leverage and credit expansion.

- Memetic Capitalism is built on laughter and expression.

Liquidity has detached from labor and fused with expression. Humor has replaced scarcity as the primary anchor of value. In the symbolic economy, every cartoon face becomes a derivative instrument of collective emotion.

Conclusion

The market does not end in collapse, but in recursion. Memecoins endure not because they make sense, but because they make faith visible. In that sense, they are the most honest financial instruments of our time. They do not pretend to be anchored in “fundamentals” that are often just as manufactured as the memes themselves.

The joke is the protocol. The laughter is the ledger. The exit is the prayer. To navigate the symbolic economy, you must realize one thing. The asset isn’t the token. It’s the velocity of the belief it carries. The stage is live, the meme is the mint, and the crowd is the only auditor that matters.

Further reading:

Why Crypto Slips While U.S. Stocks Soar

On October 28–29, 2025, a definitive structural divergence emerged in the global markets. U.S. equities surged to fresh highs on institutional flows. AI-driven optimism contributed to these gains. Meanwhile, the crypto market softened. Bitcoin remained flat around 115,000 dollars. Ethereum declined roughly 2%.

The global crypto market capitalization contracted even as U.S. indices pushed upward. This was not a simple price mismatch; it was an architectural divergence. Market regimes have forked, and investors must now decode the two different value systems operating in parallel.

Architecture of Divergence—Different Drivers, Different Rhythms

The split is structural. Each ecosystem is now governed by fundamentally different scaffolding, leading to diverging rhythms of growth and contraction.

Equities (Structural Flow)

Equities rehearse “Structural Flow,” anchored by institutional architecture.

- Capital Source: Driven by institutional positioning, macro hedging, and corporate buybacks.

- Risk Profile: Policy-hedged and stabilized by earnings optics and central-bank backstops.

- Outcome: Prices follow the scaffolding of cash flow and institutional mandate.

Crypto (Symbolic Belief)

Crypto rehearses “Symbolic Belief,” making it inherently fragile.

- Capital Source: Highly sensitive to retail sentiment and speculative liquidity ripples.

- Risk Profile: Narrative-reactive and tightly coupled to geopolitical fear cycles and leverage dynamics.

- Outcome: Prices follow narrative momentum and are subject to sudden symbolic unwinds.

The divergence between crypto and equities signals deeper systemic fault lines. Equities price the scaffolding of the system, while crypto prices the belief in the alternative.

Key Breach Lines of the Forked Market

Three key breach lines define this separation and explain why “Risk-On” is no longer a universal tide.

- Liquidation Cascades: Crypto saw approximately 307 million dollars in leveraged liquidations within a 24-hour window. Liquidations accelerate decline through reflexivity; crypto doesn’t just trade, it unwinds symbolically.

- Optical Inflows: Spot Bitcoin ETFs attracted roughly 149 million dollars in inflows during this period, yet prices remained flat. This proves that ETF inflows do not equal insulation; they rehearse belief optics without providing structural depth.

- Risk-On Fragmentation: The concept of “risk-on” has fractured. It is now asset-class specific. Crypto breadth remains uneven and sentiment-fractured, even as equity indices reach record highs.

ETF inflows do not provide a floor when the underlying asset is dominated by leveraged reflexivity. In the crypto regime, cascades matter more than fundamentals.

The Investor Audit Protocol

The durability of this divergence requires decoding the value regimes correctly. To navigate this landscape, investors must adopt a new forensic discipline.

How to Decode the Forked Stage

- Spot the Scripts Beneath the Flows: Recognize that equities price cash-flow scaffolding while crypto prices narrative momentum. Don’t mistake a rally in one for a guarantee in the other.

- Assess Infrastructure Alignment: Identify which assets are embedded in real infrastructure, such as compute, storage, and energy. Determine which assets are acting purely as symbolic stand-ins.

- Align With Your Sphere of Control: If you trust institutional sovereignty (corporations, states), equities offer recognizable governance. If you align with crypto sovereignty (decentralization, belief networks), you must prepare for symbolic volatility.

Conclusion

Crypto and equities are rewinding different storylines. The real question is no longer “Why is crypto lagging?” but rather “Which value regime am I participating in?”

Market regimes have forked. One is built on the architecture of institutional flow; the other is built on the choreography of symbolic belief. The investor must choose their narrative—and what they trust.

Further reading:

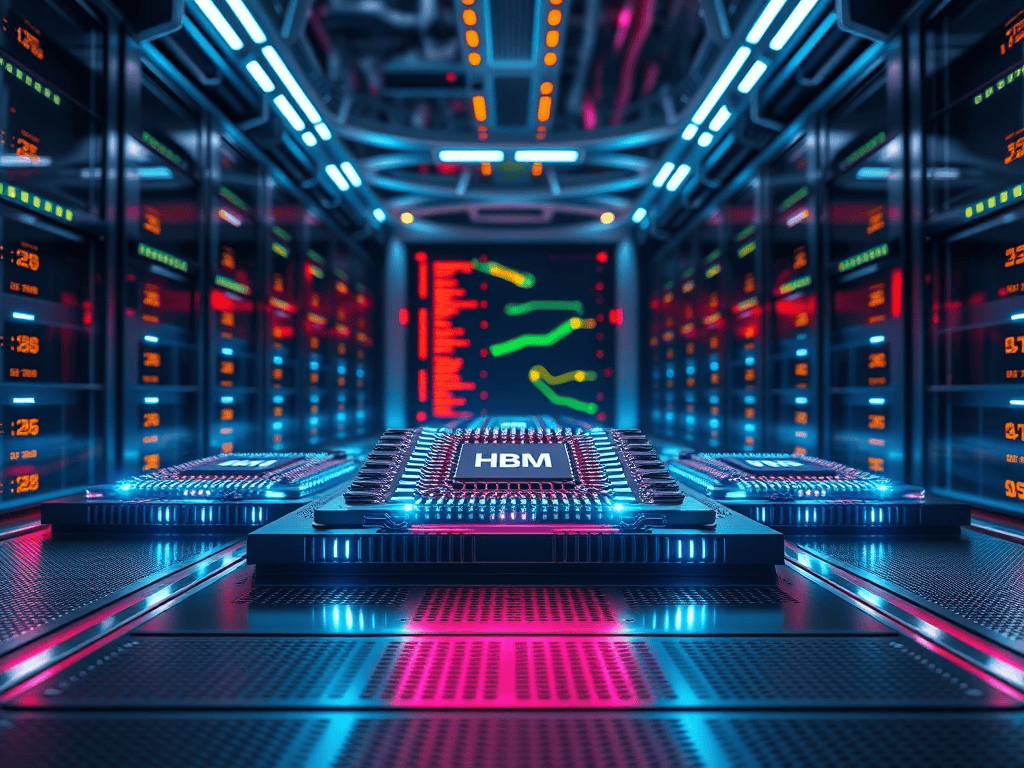

Chips are not Minerals

In October 2025, SK Hynix performed a market gesture that defied traditional hardware cycles. The company revealed that it had already locked in 100% of its 2026 production capacity for High-Bandwidth Memory (HBM) chips.

This is not a normal pre-sale. It is a move typically seen only in markets defined by strategic scarcity. Examples include rare earth minerals or oil. Nearly all of this inventory is headed toward NVIDIA’s training-class GPUs and the global AI data-center build-out. While SK Hynix reported record-breaking revenue—up 39% year-over-year—the 100% lock-in signals a transition from hardware flow to “Sovereign-Grade” infrastructure allocation.

Choreography—Memory as Strategic Reserves

When hyperscalers commit to 2026 HBM capacity years in advance, they are not just buying components. They are pre-claiming tomorrow’s AI performance bandwidth to ensure they aren’t boxed out of the intelligence race.

- The Stockpile Mirror: This is symbolic choreography—the corporate mirror of national stockpiling. Hyperscalers are treating HBM as a “strategic reserve,” much like a nation-state secures pre-emptive oil storage.

- The Scarcity Loop: SK Hynix has warned that supply growth will remain limited. This reinforces the belief that scarcity itself is the primary driver of value, rather than just technological utility.

- Capital Momentum: The announcement pushed shares up 6% immediately, as investors rewarded the “guaranteed” revenue.

The Breach—Lock-In, Obsolescence, and the Myth of Infinite Demand

Locking in next-year supply mitigates the risk of a shortage. However, it introduces three deeper architectural liabilities. The market has yet to price these liabilities.

1. Architectural Lock-In

Buyers are committing to current HBM standards (such as HBM3E or early HBM4) for 2026. If the memory paradigm shifts, those who locked in 100% of their capacity will be affected. A superior standard, like HBM4E, may arrive earlier than expected. They will be tethered to yesterday’s bandwidth. Meanwhile, competitors will pivot to the new frontier.

2. Obsolescence Risk

In the AI race, performance velocity is the only moat. A new specification arriving early can erode the competitive edge of any player holding multi-billion dollar contracts for older-generation HBM. The “guaranteed supply” becomes a “guaranteed anchor” if the software requirements outpace the hardware specs.

3. The Myth of Infinite Demand

Markets are currently pricing HBM as if AI demand will expand linearly forever. But demand is not bottomless. If AI adoption plateaus, it affects demand. Consolidation or a shift toward more efficient small-model architectures that require less memory bandwidth will also impact it. In such scenarios, the scarcity ritual becomes expensive theater.

The Investor Audit Protocol

For any reader mapping this ecosystem, the SK Hynix signal demands a new forensic discipline. Navigating this sector requires distinguishing between genuine margin cycles and scarcity-fueled momentum.

How to Decode the HBM Stage

- Audit the Architecture: Approach the memory market like strategic infrastructure allocation, not speculative hardware flow. Don’t look at the volume; look at the spec version being locked in.

- Track Architecture Drift: HBM4 is the premium tier today. Ensure the suppliers have a visible and credible roadmap to HBM4E. Also ensure they have a roadmap to HBM5. Verification sits in the roadmap, not the revenue report.

- Challenge the Belief: HBM prices reflect a belief in bottomless infrastructure demand. Lock-in becomes a liability if the AI software layer optimizes faster than hardware assumptions can adapt.

- Distinguish Value from Symbolism. Determine if the current valuation is based on the utility of the chip. Consider if it is due to the symbolic fear of being left without it.

Conclusion

The next major breach in the AI hardware trade won’t be a lack of supply. It will be the realization that the supply being held is the wrong spec for the current moment. When 100% of capacity is locked in, the market has no room for error.

Further reading: