Independent Financial Intelligence — and what it means for your portfolio, helping investors anticipate risks and seize opportunities.

Mapping the sovereign choreography of AI infrastructure, geopolitics, and capital — revealing the valuation structures shaping crypto, banking, and global financial markets, and translating them into clear, actionable signals for investors.

Truth Cartographer publishes independent financial intelligence focused on systemic incentives, leverage, and powers — showing investors how these forces move markets, reshape valuations, and unlock portfolio opportunities across sectors.

This page displays the latest selection of our 200+ published analyses. New intelligence is added as the global power structures evolve — giving investors timely insights into shifting risks, emerging trends, and actionable opportunities for capital allocation.

Our library of financial intelligence reports contains links to all public articles — each a coordinate in mapping the emerging 21st‑century system of capital and control, decoded for its impact on portfolios, investment strategies, and long‑term positioning for investors. All publications are currently free to read.

[Read our disclaimer and methodology on the About Us page]

The Manufacture of Financial Reality

Markets once measured trust in earnings. Now they measure how well belief can be simulated. Synthetic sentiment doesn’t just track public mood — it manufactures it. Across industries, Artificial Intelligence (AI) no longer observes the system; it scripts it. The result is a financial environment where institutions approve optics instead of auditing architecture.

How Synthetic Sentiment Operates

The deception works because institutions still assume that what looks official must be true. Synthetic sentiment exploits this choreography of assumed legitimacy by subverting the verification process itself.

1. It Rehearses Redemption

AI tools generate artifacts—receipts, itineraries, confirmations, and reports—that look procedurally correct. Automated approval systems read the pattern and grant clearance.

- The Mechanism: The rehearsal becomes indistinguishable from the real act.

- The New Fraud: Fraud today is not merely the act of falsification. It’s the rehearsal of belief.

2. It Collapses Verification

Synthetic artifacts bypass verification because they exploit visual trust.

- The Blind Spot: Audit pipelines depend on surface-level cues, and those cues are now trivially reproducible.

- The Result: Synthetic normality becomes a blind spot.

3. It Creates Loops

AI-generated claims trigger AI-generated responses, audit checks, and Human Resources (HR) confirmations.

- The Loop: Fraud circulates inside the workflow—self-reinforcing, self-defending, and fully synthetic.

- The Architecture: Synthetic legitimacy doesn’t just fool the system. It becomes the system.

Case Studies in Synthetic Finance

The risk is not theoretical. AI can simulate legitimacy. This ability is already being weaponized in the corporate and financial sectors. It forces criminal prosecution.

Hong Kong Deepfake CFO Scam (2024)

- The Breach: An employee authorized a $25 Million transfer. This happened after joining a video call. The call was populated entirely by deepfake participants—Chief Financial Officer (CFO), colleagues, background chatter.

- The Revelation: Every identity on the call was AI-generated. The fraud succeeded because the entire chain of command was synthetically reconstructed to simulate procedural legitimacy.

DOJ v. Patel (2025)

- The Breach: Patel used chatbots and cloned voices to impersonate bank officers, initiate transfers, and forge synthetic audit chains.

- The Classification: The Department of Justice (DOJ) formally classified this weaponization of AI-generated legitimacy as aggravated financial crime.

The New Enforcement Architecture

The judicial and regulatory systems are now recognizing that the breach is not technical—it is theatrical.

In 2025, the U.S. DOJ started a multi-agency task force. It collaborates with the Securities and Exchange Commission (SEC), Financial Crimes Enforcement Network (FinCEN), and Federal Bureau of Investigation (FBI). Their focus is on AI-enabled financial deception. The new standard targets the simulation of legitimacy itself—documents, voices, workflows, and audit loops.

- DOJ Statement (2025): “Weaponizing AI to simulate legitimacy will be prosecuted as systemic fraud. Institutions must audit choreography, not just credentials.”

- The Inversion: Enforcement now recognizes that the breach is not technical—it’s theatrical.

The Investor’s New Discipline

In this theater of synthetic sentiment, investors must decode choreography before they can price risk.

What the Citizen–Investor Must Now Do

- Audit the Optics—Not Just the Metrics: Ask what legitimacy is being rehearsed. Are dashboards or AI-generated materials shaping perception?

- Interrogate the Workflow: If the verification chain is automated, fraud might already be rehearsed. This can occur inside Customer Relationship Management (CRMs), invoice portals, and compliance queues.

- Demand Redemption Discipline: Firms must disclose how they authenticate AI outputs. Do they run a synthetic-sentiment firewall?

- Track DOJ and Sovereign Signals: Companies caught in synthetic workflows face liquidity freezes, criminal exposure, and regulatory shadowing.

- Codify Symbolic Scarcity: The safest value is architectural—built in systems that still require human reconciliation.

Conclusion

The next breach will not be in the code; it will be in the choreography. The citizen must now become a forensic reader of emotional and financial liquidity. Audit your stage, not your story. Learn to read choreography: timestamps, transaction trails, linguistic symmetry, chain-of-custody cues. Assume every document is potentially synthetic until anchored in verified human oversight.

Further reading:

Market Risk is Hiding in the Net Margin Compression

The Question That Misses the Stage:

“Where the hell is the market risk?” — Treasury Secretary Scott Bessent, October 2025.

He meant it rhetorically. Markets are up. Inflation has cooled. Artificial Intelligence (AI) stocks are soaring. But the answer is hiding in plain sight: risk is no longer in credit, liquidity, or even leverage.

The market appears resilient because the optics are synchronized. The underlying risk is severe. It resides in the gap between the symbolic scaffolding that supports valuation and the decaying structural integrity beneath it.

The Architecture of Fragility—Redemption Collapse

The new markets are built not on fundamentals but on a fragile belief infrastructure where symbolic redemption replaces structural stability.

Redemption Fragility

- Sovereign Debt: Sovereign bonds once represented a procedural covenant. Now, as issuance scales and buybacks multiply, even sovereign credit trades like a performance of credibility.

- The Crash Trigger: If redemption is staged—not earned—markets can collapse not on fundamentals but on optics. Markets don’t crash on fundamentals anymore. They crash on choreography—when belief can’t be redeemed.

Institutional Erosion

The foundations of market trust are dissolving through political action that supersedes the rulebook.

- Erosion of Independence: The Federal Reserve’s independence is now a bargaining chip.

- Inversion of Standards: Regulatory standards are being inverted. There are pardons for crypto executives, like Changpeng Zhao. There is selective enforcement of Anti-Money Laundering (AML) rules. Fiscal announcements are shaped for sovereign theater. The state no longer disciplines markets; it choreographs them.

Belief Inflation—The AI Engine

The AI spending boom is the primary engine of this Belief Inflation—a statistical illusion of expansion that masks underlying fragility.

- Statistical Illusion: Global AI Capital Expenditure (capex) has surged toward the $375 Billion mark. It is projected to hit $500 Billion by 2026. U.S. Q2 Gross Domestic Product (GDP) numbers are padded by more than a full percentage point from AI-related outlays alone.

- Theatrical Performance: This capex turns into the temporary scaffold of national growth. Governments are framing AI as sovereign resilience, but the performance is theatrical: spending isn’t innovation—it’s choreography.

Protocol Sovereignty—The Mirror of Statecraft

Crypto protocols have become mirrors of statecraft, mimicking sovereign action to mint their own legitimacy.

- Mimicry: Through token buybacks, burn schedules, and staged scarcity rituals, platforms now mimic central bank behavior.

- Politicized Legitimacy: The pardon of Changpeng Zhao institutionalized this logic: compliance became negotiable so long as optics aligned.

- Dissolving Border: The border between fiscal and protocol choreography has dissolved. Sovereigns mint legitimacy through capital optics; protocols mirror the state through burn optics.

Where the Market Risk Actually Lives (The Russell 2000)

The surface market looks resilient because the optics are synchronized. But the underlying risk is acute in the less-liquid segments, which serve as the real-time structural ledger.

- Valuation Extremes: The small-cap Russell 2000 shows a Cyclically Adjusted Price-to-Earnings (CAPE) ratio above 54. This level signals symbolic inflation. It does not indicate profit strength.

- Net Margin Collapse: Net margins in the iShares Russell 2000 ETF (IWM) are collapsing. They have decreased by a full third year over year. This reveals an earnings structure that is thinning even as belief inflates.

- Consumer Fragility: Consumer spending is rising through credit, not cash flow. This turns optimism into a rehearsed gesture rather than an earned outcome.

- Labor Lag: Job creation has stalled, a lag masked by sampling noise and narrative pacing.

Net margin compression in the Russell 2000 is the breach beneath symbolic growth. The economy appears resilient because the optics are synchronized—not because the foundations are strong. The investor who chases AI-driven capex but ignores Russell 2000 earnings compression is misreading the stage.

Conclusion

The market risk is not missing; it has gone epistemic. It exists in the widening gap between symbolic scaffolding—AI capex, sovereign narrative discipline, and protocol mimicry. This contrasts with the structural reality of eroding margins, unserviceable debt, and institutional decay. Sovereign actors and protocols are choreographing resilience to defer gravity. The risk isn’t in credit; it’s in the choreography literacy of the audience.

Further reading:

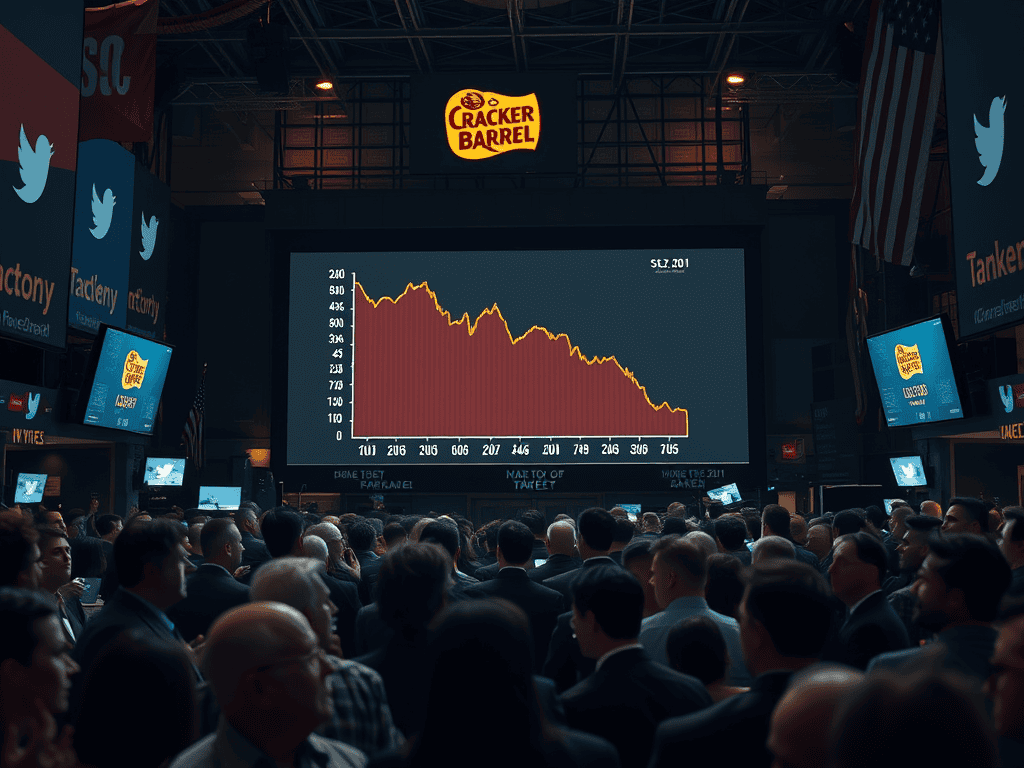

Synthetic Sentiment and the Cracker Barrel Collapse

In August 2025, Cracker Barrel Old Country Store Inc. unveiled a refreshed logo, removing the familiar “Old Timer” figure. Within hours, social feeds erupted with boycott calls and moral condemnation.

The data told a different story. Out of 52,000 posts on X during the first 24 hours, nearly half showed automated or bot-like signatures. Close to 49 percent of boycott-tagged posts exhibited patterns of synthetic coordination. What looked like genuine public fury was rehearsed mimicry—an engineered emotional cascade.

Choreography—How Synthetic Sentiment Manufactures Emotion

The actors were not crude spam accounts; they were belief simulators. Using generative Artificial Intelligence (AI), they constructed arguments, mimicked human cadence, and echoed cultural grievances.

- The Goal: Their work wasn’t persuasion; it was amplification. Synthetic sentiment doesn’t seek accuracy. It seeks velocity. It rehearses consensus at a pace no human movement can match.

- The Performance: The illusion of revolt was powerful enough to push Cracker Barrel’s stock down six percent intraday. Investors then realized that fundamentals had not changed.

When Optics Overtake Fundamentals

Cracker Barrel’s financials were stable. Revenue, Earnings Per Share (EPS), and guidance had not shifted. Yet analysts briefly adjusted brand-risk models because the conversation density restored a dangerous truth: valuation now includes optics.

- The Inversion: Earnings matter. But the perceived legitimacy of earnings matters more. Price can be moved not by performance but by performance of sentiment—an inversion where narrative volatility becomes financial volatility.

- The Sovereign Actor: Synthetic sentiment has evolved into a sovereign force—a programmable derivative of public emotion. It collapses brands without touching the balance sheet. It reshapes reputations without any organic constituency. It forces markets to price illusions as if they were signals.

The Cracker Barrel stock drop confirms that modern reputational risk is programmable. The spectacle of confidence—or the staged collapse of it—is now a tradable asset.

The New Market Physics

The Cracker Barrel incident mirrors a broader structural landscape where symbolic performance is substituting for architectural integrity across multiple domains:

- AI rehearses innovation optics.

- Crypto rehearses liquidity optics.

- Governments rehearse stability optics.

- Bots rehearse citizen optics.

All of them feed a single belief engine: the spectacle of confidence. The market reacts long before verification arrives.

Citizen Impact—Learning to Read the Signals Correctly

For citizens and investors, the Cracker Barrel incident is not a social-media glitch. It is a warning flare: reputational volatility is now programmable. Outrage can be manufactured. Consensus can be simulated. Collapse can be staged.

- The Challenge: The challenge isn’t misinformation—it’s misperception, the ability to confuse coordinated choreography with authentic dissent.

- The New Literacy: The citizen must now become a forensic reader of emotional liquidity. They need to analyze velocity, coordination patterns, and generative signatures. This helps distinguish genuine dissent from synthetic influence.

Conclusion

The Cracker Barrel incident proves that modern reputational risk does not begin with misconduct. It begins with synthetic belief. Outrage no longer tracks behavior; it tracks velocity. Trust no longer erodes slowly; it collapses in seconds. And the markets react long before verification arrives.

The next major brand failure won’t start with a scandal. It will start with choreography—emotional liquidity masquerading as public sentiment. The next reputational collapse won’t begin with bad behavior. It will begin with synthetic belief.

Further reading:

Assumable Mortgages and the Bypass of Monetary Policy

In a housing market choked by 7%–8% interest rates, a counter-current has emerged. It is not found in new construction or refinancing booms. Instead, it exists in the transfer of old paper. Assumable mortgages, once a bureaucratic footnote, have become the architecture of quiet rebellion. They allow a buyer to inherit the seller’s existing mortgage—often at sub-3%—silently bypassing the Federal Reserve’s primary policy lever. What once seemed like simple paperwork has transformed into a redemption ritual. Citizens are inheriting liquidity from a past cycle. They do this to evade the monetary regime of the present.

Choreography—How Rate Immunity Is Rehearsed

Assumability is limited mainly to Federal Housing Administration (FHA), Veterans Affairs (VA), and U.S. Department of Agriculture (USDA) loans—legacy programs that now behave like time capsules of a low-rate era. In 2025, assumption activity surged over 127%.

- The Mechanism: Each assumption is a small, legal refusal: a decision to inherit liquidity instead of submitting to policy.

- Concentration: The pattern concentrates in states where migration, affordability stress, and military corridors intersect, creating clusters of rate-immune zones.

When Bypass Becomes Systemic, the Transmission Chain Frays

Monetary policy works by raising the cost of new credit. Assumables fracture that design. If the trend scales, the housing market splits into two liquidity classes, undermining the intended effects of Federal Reserve tightening.

The Two Liquidity Classes

- Legacy Liquidity (Rate-Immune Zones):

- Mechanism: Properties carrying inherited low-rate debt (sub-3%).

- Result: Affordability survives policy; price stabilization or upward pressure due to scarce, attractive debt.

- New Issue Fragility (Policy-Exposed Zones):

- Mechanism: Homes financed at 7%–8% interest rates.

- Result: Fully exposed to tightening; high monthly payments; slower sales velocity.

The result is a structural break: the Fed can raise rates, but the market increasingly rehearses evasion.

Liquidity fragmentation is sovereign theater. If even 10% of transactions become assumable, the Fed’s tightening becomes performative. The policy is raised on stage. Meanwhile, the audience quietly exits through side doors. Monetary sovereignty fractures at the household level: the rate is national, but liquidity becomes inherited and local.

The Citizen’s Map: How the Bypass Actually Works

The mechanics remain fully legal but tactically hidden. This demands that buyers adopt an Access Audit Protocol to find and secure these rate time capsules.

The Access Audit Protocol

- Ask Relentlessly: Is the mortgage FHA, VA, or USDA? What is the inherited rate, balance, and remaining term?

- Map the Omission: Listings often omit assumability, either from ignorance or strategic concealment.

- Redemption Math: The low monthly payment needs consideration. It’s crucial to weigh it against the equity bridge. This is often $50,000 to $200,000 in cash. This amount represents the difference between the sale price and the inherited loan balance.

- Neighborhood Clusters: Neighborhood clusters of assumables form pockets of rate immunity. This forms an emerging cartography of monetary evasion. It is visible only to those who know to look.

Investor Choreography: The Hidden Yield Engine

For investors, inherited debt becomes a powerful yield engine. It creates high cash-flow margins on identical rents. This further incentivizes the use of this mechanism.

- Yield Arbitrage: A 2.75% legacy mortgage versus a 7.5% new issuance translates into a dramatically higher cash-flow margin on identical rents.

- Policy Shield: The asset gains a powerful shield against future Fed tightening cycles.

Investors are incentivized to seek out these Legacy Liquidity zones. The equity bridge becomes the price of admission to a property with policy-immune cash flows. This demonstrates how structural arbitrage emerges when monetary policy transmission is compromised.

Conclusion

The quiet rebellion of the assumable mortgage proves that policy failure is often met with citizen-level ingenuity.

- Rehearse Due Diligence: Ask every agent about assumability, every time.

- Map the Bypass: Track clusters of legacy liquidity—they reveal where policy loses traction.

- Refuse Optics: “Free rate inheritance” can disguise aggressive equity demands.

- Codify Redemption: If you inherit a low-rate mortgage, protect it with documentation, verification, and rigorous title review.

Further reading:

ETFs vs Tokenized Assets in the New Age of Liquidity

The Asset Doesn’t Just Exist. It Performs Legitimacy.

By late 2025, the boundary between Exchange-Traded Funds (ETFs) and tokenized commodities has dissolved. BlackRock’s iShares Bitcoin Trust normalized crypto exposure for institutions. At the same time, GoldLink Decentralized Autonomous Organization (DAO), Paxos Gold (PAXG), and Tether Gold turned bullion into programmable liquidity.

ETFs live inside traditional economics—audited, regulated, fiat-redeemable. Tokenized assets live inside protocol choreography—transparent on-chain, opaque off-chain, and staged for narrative effect. Both rely on a symbolic layer to sustain trust.

The Dual Performance of Stability

The core belief problem is identical in both worlds. The citizen invests in a promise of convertibility. This promise is sustained through performance. It is not necessarily secured by structural enforceability.

The ETF Model: Stability Performed Through Regulation

Even in heavily regulated funds, redemption is symbolic, not structural.

- Redemption Illusion: Custodians hold assets, but retail investors rarely touch what they own. Redemption typically yields fiat, not the underlying metal.

- Symbolic Disclosure: ETFs don’t codify stability—they rehearse it, in quarterly disclosures and custodian statements that stand in for convertibility. Tracking error can widen when derivatives multiply the distance between the claim and the commodity.

The Tokenized Model: Redemption as Mirage

Tokenized commodities claim to democratize access, but rely on vault optics and sovereign tolerance.

- Custodial Opacity: Most protocols publish PDFs, not live attestations. Custody frequently sits in offshore vaults with ambiguous jurisdictional reach.

- Redemption Illusion: Some promise physical redemption; others reference assets without enforceable convertibility. Tokenization doesn’t remove risk—it stages transparency while hiding the custodial spine.

Digital Choreography: The New Audit Trail

Digital choreography is the performative grammar of modern financial truth. The system will not fail due to the code transferring the token. Instead, it will fail in the choreography that hides the constraint on redemption.

- Interface Deception: Dashboards simulate convertibility with glowing “1:1 backed” icons.

- Staged Custody: Custody is validated through staged vault photos and influencer tours rather than independent, third-party verification.

- Invisible Constraints: Smart contracts automate transfers but leave redemption dependent on discretionary keys. Users trust the interface more than the ledger—and the interface is designed to perform legitimacy.

Policy Begins to Absorb the Choreography

Regulation is now catching up by embracing what it cannot fully control, merging traditional finance (TradFi) rails with cryptographic plumbing.

- SEC and On-Chain Settlement: The SEC’s Digital Commodity Guidance now allows partial on-chain settlement for registered funds. This merges ETF rails with cryptographic plumbing.

- UK Token Recognition: The UK’s Financial Markets and Digital Assets Act recognizes tokenized commodities as regulated investment contracts. This enables funds to tokenize up to 20% of their underlying.

The Investor’s Matrix: What Must Now Be Decoded

This isn’t financial advice—it’s map-reading for belief economies. Investors must read not only balance sheets but semiotics.

Investor Audit Checklist: Decoding Belief

- Audit Redemption: Is convertibility enforced by code, custodian, or promise? If automation stops at the vault door, redemption is theatrical.

- Track Symbolic Inflation: When market capitalization outruns verified collateral, belief is inflating faster than backing.

- Map Sovereign Choreography: Regulatory alliances and political endorsements can protect—or capture—platforms.

- Diversify Belief Infrastructure: Combine on-chain attestations, traditional audits, and independent verification.

- Decode Interface Signals: The smoother the dashboard, the more invisible the constraints beneath it.

Conclusion

In the merging economies of ETFs and tokenized commodities, assets no longer rely solely on fundamentals. They rely on choreography—on how redemption is staged, how custody is framed, and how interfaces perform trust. The investor must read not only balance sheets but semiotics. Not only disclosures but symbolism. Not only collateral but choreography. The next frontier of investing is epistemic. Those who learn to audit belief will survive. They will endure what those who audit price alone cannot.

Further reading: