Summary

- Apple’s $4 trillion valuation reflects discipline and containment, not boundless growth.

- A $600 billion manufacturing and geopolitical play (AMP) fortified supply chains but redirected risk capital.

- Apple traded frontier ambition for structural security — and in doing so, ceded AI frontline dominance.

- When stability becomes identity, innovation can fade; Apple’s fortress risks becoming a quiet cage.

A Mirror, Not a Compass

In late 2025, Apple briefly crossed the $4 trillion valuation milestone — a rare feat shared only with a handful of corporations. On its face, this signals strength and market confidence.

But the true meaning of Apple’s valuation isn’t about raw scale. It’s about where Apple chose to place its capital — and what it traded in exchange.

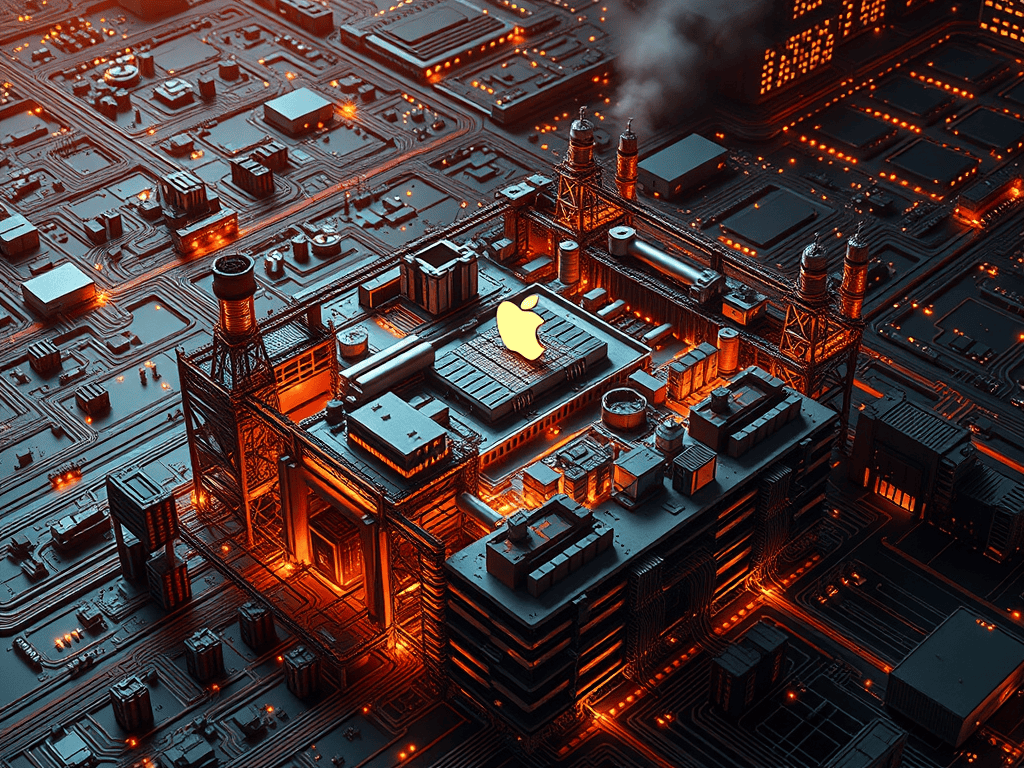

What Apple built with its capital matters just as much as the valuation it earned. In Apple’s case, fortress building edged out frontier expansion.

Containment as Strategy — the $600 Billion American Manufacturing Program

In response to macroeconomic pressures — tariffs, supply-chain risk, and geopolitical scrutiny — Apple deployed approximately $600 billion into the American Manufacturing Program (AMP).

This program had three logical purposes:

- Shield supply chains from geopolitical disruption

- Neutralize tariff exposure by localizing production

- Build political capital and industrial diplomacy

The AMP was a masterstroke of containment — an investment into stability rather than speculation. It fortified Apple’s existing strengths: supply-chain resilience, manufacturing security, and domestic political support.

But every containment strategy carries a trade-off.

The Opportunity Apple Didn’t Chase

If Apple had chosen creative velocity over strategic containment, its resources could have reshaped entire technological frontiers.

Here’s what that alternate Kodak Apple might have pursued instead:

- A sovereign large language model empire

- A global network of frontier AI research labs

- Mainstream expansion of spatial computing (Vision Pro and beyond)

- Strategic acquisitions (Arm, Adobe, Spotify, etc.)

- Massive renewable data-center campuses to codify compute sovereignty

All of these were financially feasible. The capital existed. The question was not whether Apple could have spent it — but what it chose to spend on.

Containment vs. Frontier: The Trade-Off

Apple’s containment logic prioritized defense over offense. It reinforced existing advantages — premium brand, hardware ecosystem, Services — instead of power projection into unknown territory.

This paid immediate dividends. It:

- Reduced geopolitical risk

- Fortified the brand’s stability narrative

- Reassured investors worried about tariffs and China exposure

But it also meant outsourcing the next frontier of artificial intelligence and compute innovation to others.

In choosing a fortress, Apple ceded:

- AI model sovereignty (outsourced to OpenAI)

- Infrastructure dominance (outsourced to hyperscalers like Google)

This is not a collapse — it’s a controlled retreat into fortification.

When Stability Becomes Confinement

There’s a subtle danger in making discipline your identity.

Stability buys you resilience.

Too much stability can also inhibit imagination.

Apple’s valuation now reflects trust in its predictable cash flows, margins, and ecosystem lock-in. But that same valuation also reflects a forward-looking assumption — that Apple can continue to mine growth from within its existing perimeter.

When a company’s valuation depends on confidence in continuance rather than belief in transformation, the margin for error narrows.

In a world where AI, compute, and platform economies are rapidly rewriting competitive boundaries, the risk isn’t falling apart — it’s becoming an ossified fortress amidst dynamic frontier forces.

Conclusion

Apple’s $4 trillion valuation is a mirror, not a compass.

It reflects:

- trust in continuity

- confidence in containment

- belief in perpetuity

What it does not reflect is ownership of the frontier.

Containment protects the present — but it also shapes the future by what it leaves unbuilt.

In Apple’s case, the fortress protects the ground beneath its feet — but leaves the map of the future in the hands of others.

Further reading: