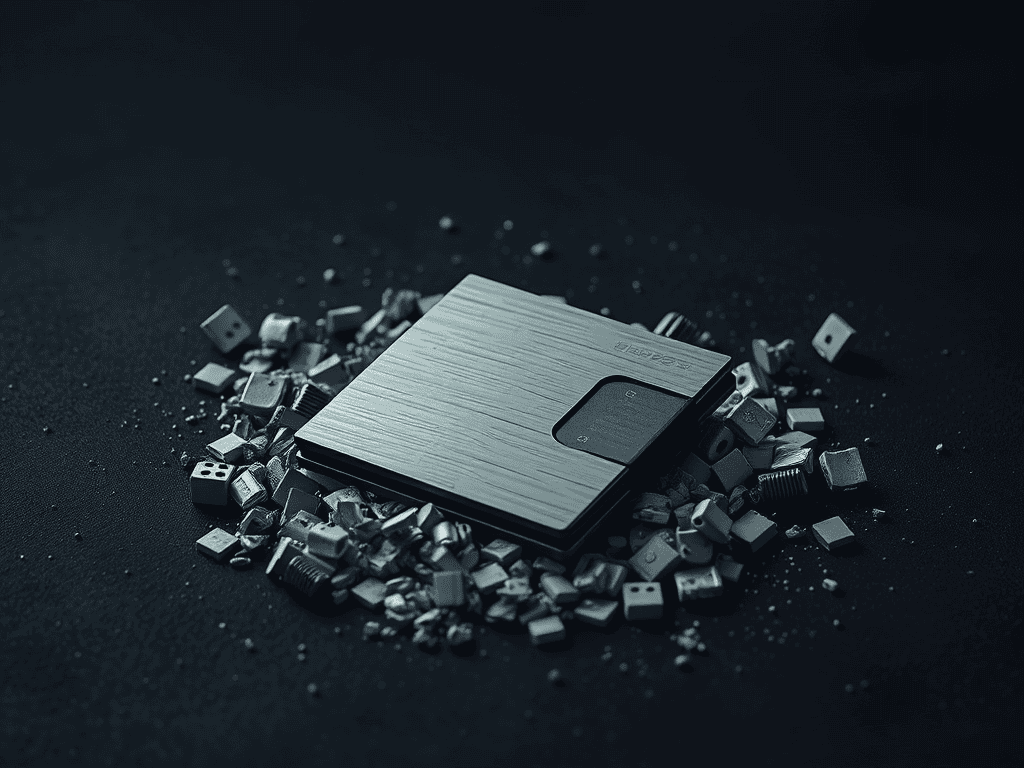

In the global theater of digital assets, the headline is currently dominated by volatility and liquidation. But the real story is found in the “Rubble.” As the broader market contracts, a specific class of assets—privacy coins and hardware wallets—is rising in defiance.

Zcash’s 1,700 percent rally, Railgun’s 50 percent surge, and record-breaking sales for hardware manufacturers all illustrate a crucial market principle. When fear peaks, survival instinct activates. Every panic rewrites the economic base. The winners of the next cycle are those quietly building the architecture of preservation. They work while the crowd is distracted by the collapse.

Custody Panic—The Trigger Clause

The 2025 hack cycle has been a “Material Breach” of trust. Over 3 billion dollars in on-chain capital have been erased by exploits and exchange failures.

- The Withdrawal Reflex: Bridge exploits and centralized exchange vulnerabilities hit the headlines. As a result, retail users fled “hot” (connected) wallets. They preferred cold storage instead.

- Institutional Hardening: Major allocators have tightened internal custody policies, moving away from third-party risk toward direct, multi-sig hardware control.

- The Result: Sales for manufacturers like Ledger, Trezor, and Tangem have doubled or tripled. Self-custody has transitioned from a cypherpunk slogan to a structural necessity for market participation.

Hardware wallets are the “Sovereign Oxygen” of the digital economy. In a period of systemic distrust, the market stops pricing “yield” and starts pricing “access.” The surge in sales is the sound of the market building its own bunkers.

The Privacy Reflex—Confidentiality as a Premium

Zcash’s meteoric run is not “meme energy”; it is a Structural Rotation. Global regulators are increasing Know Your Customer (KYC) scrutiny. Transparency on public ledgers is becoming a tool for surveillance. As a result, investors are seeking “Shielded” environments.

- Overexposure Risk: Public chains like Bitcoin and Ethereum provide radical transparency. This transparency becomes a liability when liquidity drains. It also becomes a liability when forensic tracking accelerates.

- The Sanctuary Mechanism: Zcash, Monero, and Railgun leverage specific architectures. These include zero-knowledge proofs and ring signatures. These mechanisms trade total transparency for selective disclosure and transactional freedom.

- The Pricing Logic: When public ledgers become overexposed, private chains become a premium asset. Privacy is no longer an indulgence; it is the infrastructure required to move capital without triggering a “Visibility Shock.”

Volatility as Opportunity—Watching the Rubble

Market corrections do not erase innovation; they reveal which protocols possess the “Durability Moat.” The assets surviving the 2025 storms are those quietly codifying new standards for the next era.

The Survivors’ Ledger

- Zcash: Currently integrating with Solana’s high-velocity layer to provide DeFi visibility with shielded privacy.

- Railgun: Embedding zk-privacy directly into Ethereum’s programmable layer, allowing for “Dark Pool” institutional trading.

- Digitap: Linking no-KYC debit cards to real-world payment rails, creating a bridge between on-chain privacy and off-chain commerce.

- Ledger & Trezor: Evolving from simple consumer devices into the institutional custody rails that anchor sovereign wealth and corporate treasuries.

Behavioral Trend—The Whales and the Builders

There is a synchronized choreography between the “Smart Money” and the “Deep Code.”

- Whale Re-entry: Whales exit the spectacle before the collapse, but they re-enter precisely where the infrastructure is being rebuilt. They are currently accumulating privacy-focused assets and hardware-integrated protocols.

- Builder Pivot: Developers are moving away from “Token Creation” (the carnival) and toward “Protocol Preservation” (the cathedral). The focus has shifted from attracting users to protecting them.

Watching these flows tells us more about the 2026 bull phase than any headline price. The next market leaders will be the “Quiet Players.” They focused on privacy and custody during the silence of the crash.

Conclusion

Every crash tests conviction. Every hack redefines trust. The privacy coin rally and the hardware wallet boom are not speculative counter-trends. They represent the Choreography of a System Repairing Itself.

When the market collapses, the map doesn’t disappear—it redraws itself. If you are not watching the rubble, you are missing the construction site of the next cycle. Survival is the new alpha, and privacy is the new moat.

Further reading: