Summary

- Land + Power: The true bottleneck of AI’s $1T build‑out.

- Digital Realty: 3.0GW pipeline makes it the backbone of AI real estate.

- Iron Mountain: Underground assets give it a low‑cost edge.

- Quanta & AECOM: Grid‑keepers and integrators turning capital into systemic infrastructure.

Valuing AI Data Center Real Estate

In the Data Cathedral, yield gaps matter — the difference between what firms own today and what’s still in the pipeline.

Digital Realty (DLR): The 3.0 Gigawatt Giant

- MW Backlog: 3,000 MW pipeline; $500M in annualized GAAP rent signed but not yet commenced.

- Arbitrage: Nearly 20% of current revenue is “waiting to go live.”

- Signal: $7B joint venture with Blackstone — proof that investors aren’t betting on buildings, but on scarce power‑ready land.

Why it matters: Digital Realty’s backlog is a cash‑flow rocket once those megawatts switch on.

Iron Mountain (IRM): The Underground Alpha

- MW Backlog: Projected to hit ~700MW+ capacity.

- Arbitrage: Retrofitting underground vaults — faster, cheaper, naturally cooler.

- Signal: Superior Power Utilization Effectiveness (PUE) thanks to subterranean assets.

Why it matters: Iron Mountain is a low‑cost operator disguised as a legacy storage firm, turning caves into AI vaults.

The Architects of the Cathedral

If REITs are the landlords, these firms are the industrial alchemists — converting $350B of capital into infrastructure.

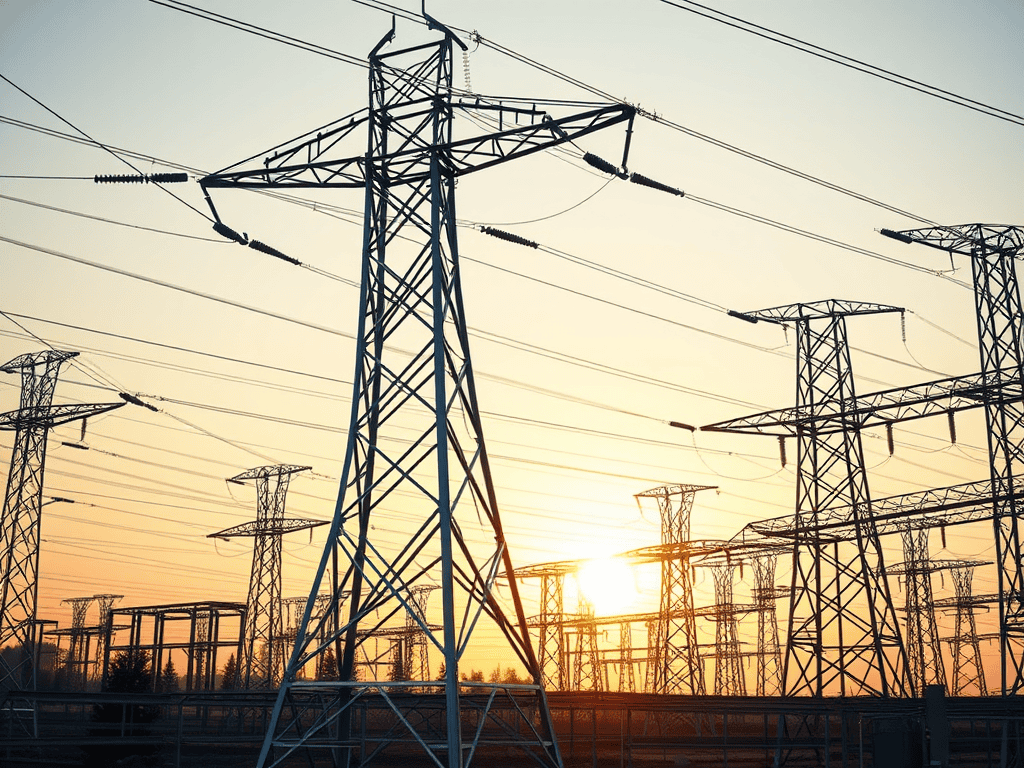

1. Quanta Services (PWR): The Grid‑Keepers

- Signal: $30B+ backlog.

- Alpha: Builds “substations‑in‑a‑box” to connect 500MW sites without destabilizing grids.

- Windfall: As hyperscalers (Amazon, Google) move toward on‑site generation, Quanta becomes indispensable as Grid‑as‑a‑Service.

Why it matters: Without Quanta, the Cathedral can’t plug into the grid.

2. AECOM (ACM): The Hyperscale Blueprint

- Signal: Paid to design liquid‑cooling facilities years before construction.

- Alpha: Integrates HVAC, water‑cooling, and rack density.

- Windfall: Operates on cost‑plus contracts — margins expand as complexity rises.

Why it matters: AECOM profits from scale and complexity, making them the systemic integrators of the Cathedral.

Conclusion

The $350B land grab is the foundation of AI’s $1 trillion build‑out.

- Land without power is worthless.

- Megawatts, not square feet, define value.

- REITs and infrastructure firms are the architects of AI’s industrial future.

The Data Cathedral is not about buildings — it’s about energy‑secure fortresses. Investors who audit the backlog, not the hype, will see where the real moat lies.

This is Part 1 of 7. Over the coming days, we will audit the remaining $650 Billion in capital flow—from the “Power Rail” to the “Resilience Layer.”

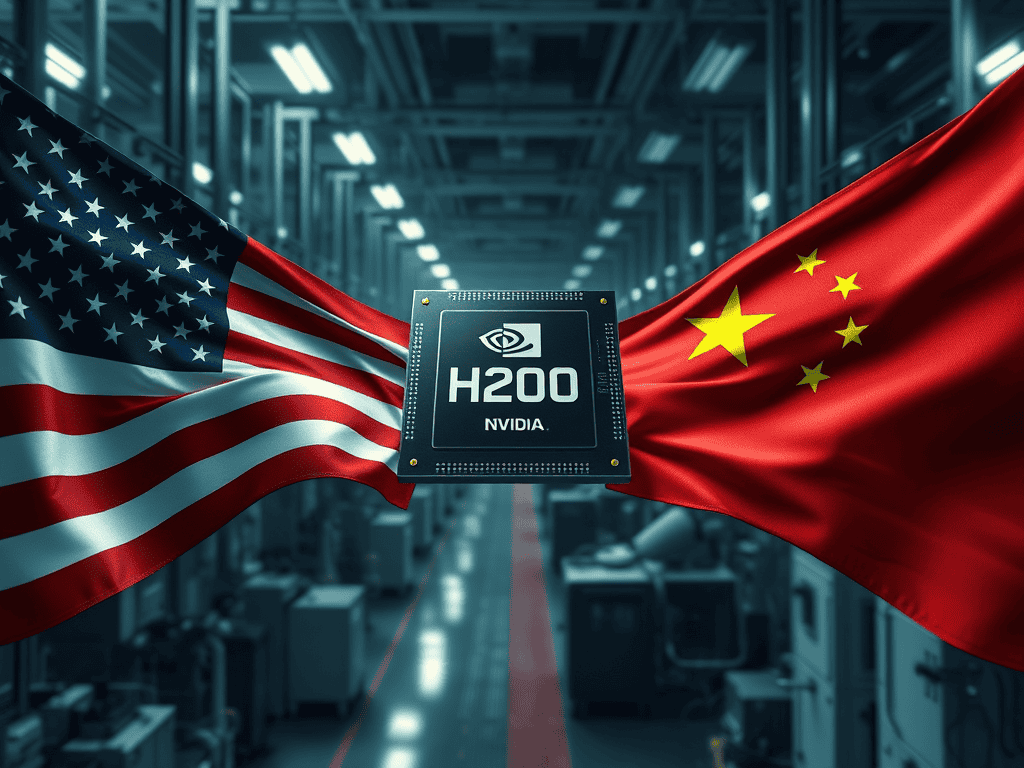

Note: This $350 billion allocation represents the estimated global expenditure for AI data center real estate through 2027. Our forensic ledger focuses on US-listed REITs and engineering firms, which currently represent the most liquid and advanced segment of this asset class. As the “Data Cathedral” is a global race, investors should utilize the ‘Megawatt Backlog’ metric to audit comparable players in international hubs such as Frankfurt, Singapore, and London.

This analysis is part of our cornerstone series on the Data Cathedral. See the full cornerstone article: The $1 Trillion Data Cathedral.