China Isn’t Just Limiting Exports. It’s Rewiring Power.

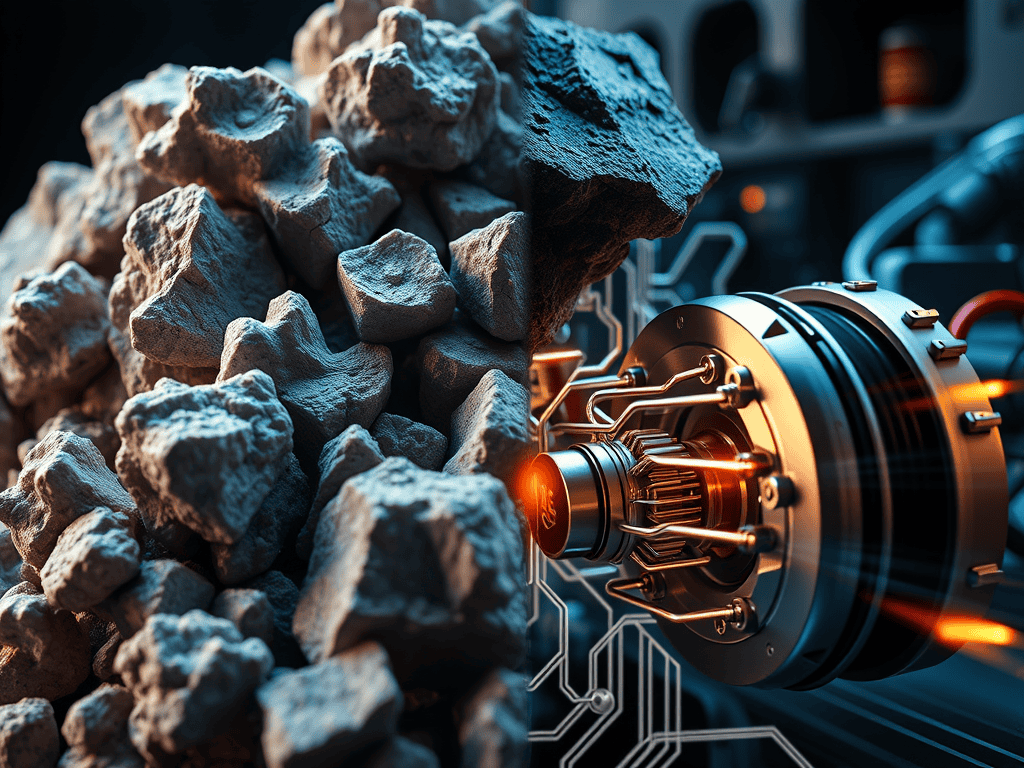

On October 9, 2025, Beijing introduced sweeping export controls on critical rare earth elements. These elements include dysprosium, terbium, and neodymium. They are metals that underpin the global semiconductor supply chain. They support AI compute hardware and EV motor production. They also play a role in defense systems and high-performance industrial magnets. This was not a trade adjustment. It was a structural rewrite. China restricted access to the minerals that power AI chips. These minerals are crucial for quantum-grade components and electric mobility. By doing so, China transformed supply chains into instruments of sovereignty. Control of the mine now equals control of the algorithm. This is not a tariff dispute. It is a strategic recalibration of global dependency.

Rare Earths Aren’t Just Materials. They’re Instruments of Leverage.

This isn’t a temporary supply disruption. It marks a geopolitical realignment. Every export license, quota revision, and customs inspection now serves as a signal. Each acts as a programmable constraint. This forces Washington, Brussels, Tokyo, and Seoul to absorb dependence. Meanwhile, Beijing executes scarcity. The EU’s Critical Raw Materials Act cannot compensate for the geographic imbalance. U.S. Inflation Reduction Act incentives cannot erase the upstream choke points. Japan’s diversification programs, scarred by the 2010 rare earth embargo, remain exposed. In this landscape, AI, EVs, and advanced manufacturing no longer move through innovation; they move through permission. Supply chains behave less like logistics routes and more like borders. The new balance of power is measured not in GDP or military budgets, but in mineral chokepoints.

AI’s Boom Isn’t Boundless. It’s Exposed.

Artificial intelligence depends on a physical substrate: magnets, wafers, high-bandwidth memory, server racks, and lidar systems—all requiring rare earth elements. As controls tighten, the trillion-dollar AI expansion shows its weak hinge. Capex rises as firms race to secure constrained inputs, but the tangible return on investment stalls. U.S. fabs—from Arizona to Ohio—still rely on minerals refined in China. European chip ambitions under the EU Chips Act confront the same bottlenecks. The story of limitless AI progress becomes an industrial test of extraction, logistics, and geopolitical access. The boom begins to resemble a belief loop. Confidence is treated as a commodity. Optimism is counted as output. Risk is priced as innovation.

Crypto’s Decentralization Isn’t Freedom. It’s Dependency.

Crypto’s architecture claims autonomy, yet its infrastructure is materially tethered. Mining rigs, data centers, validator hardware, and high-efficiency GPUs all require rare earth inputs. When those materials constrict, digital independence collapses into physical reliance. Protocols still speak the language of decentralization, but their lifeblood flows through supply chains curated, refined, and dominated by China. The narrative of sovereignty dissolves into a commodity dependence the industry refuses to name. A decentralized ledger cannot compensate for a centralized mineral bottleneck.

Gold’s Revival Isn’t Stability. It’s Escape.

As supply chains tighten and currencies wobble, gold breaks historic levels—driven not by yield, but by flight. Investors exit the engineered optimism of equity markets and the choreographed volatility of crypto. Gold becomes less a store of value and more an exit valve. The surge signals a deeper fracture: trust in the global financial architecture is eroding faster than the architecture itself. When every asset class innovates yet remains fragile, investors turn to gold. It requires no narrative and no industrial input—only belief. Gold rallies when systems expand faster than the trust that sustains them.

Conclusion

Rare earths have become the lever of modern sovereignty. Supply chains have become geopolitical borders. AI, crypto, and global markets now orbit a gravitational center defined not by ideology, but by minerals. Collapse, in this choreography, is not sudden. It is rehearsed—through scarcity, dependency, and the quiet conversion of raw materials into strategic authority. In this system, rare earths are no longer commodities. They are commands. And every economy that relies on the next generation of compute must now navigate a world where minerals dictate destiny.

Further reading: