The contest between the United States and China has transitioned into a new physical and digital layer. The focus is no longer merely on who reaches orbit or plants a flag. Instead, it is about who controls the compute, data, and developer ecosystems that run through the vacuum.

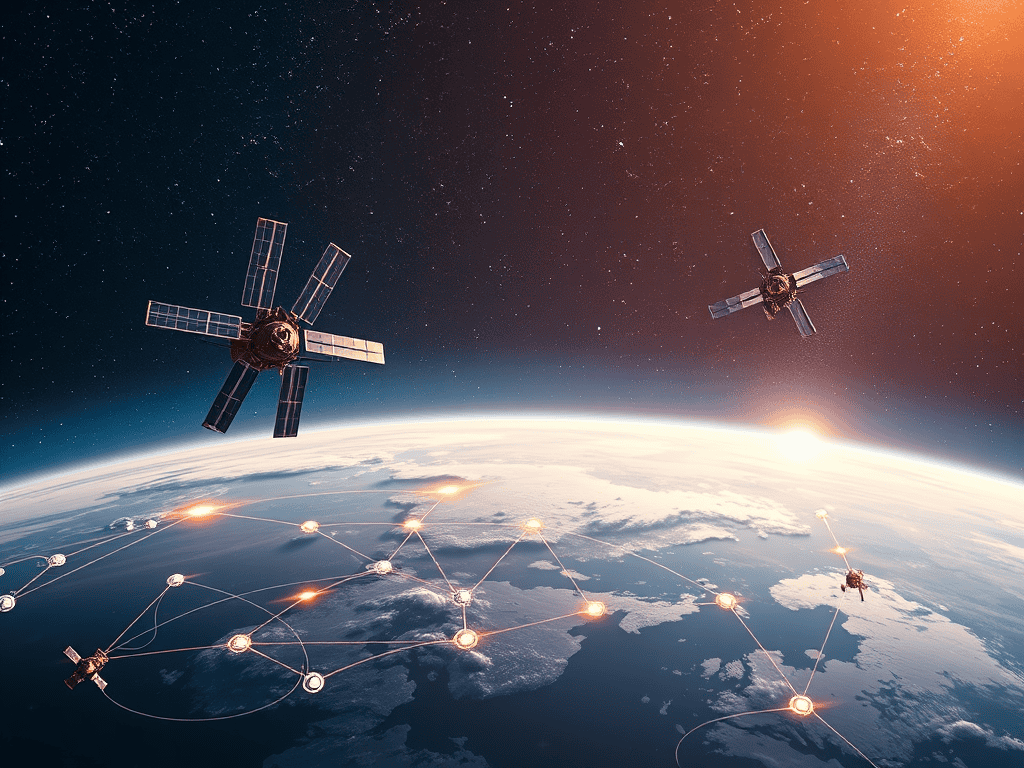

Space has become a high-velocity interface for Artificial Intelligence (AI) deployment, model distribution, and collapse containment. In the 2025 landscape, the final frontier is being recoded as a programmable layer of the global AI economy.

Infrastructure Contrast—Commercial Stack vs. Command Stack

The architecture of orbital power reveals two fundamentally different scripts.

The U.S. Commercial Stack (Decentralized Node Logic)

U.S. orbital logic is decentralized, corporate, and Application Programming Interface (API)-driven.

- Amazon’s Project Kuiper: It is planned as a constellation of 3,236 satellites. Kuiper links orbital hardware directly to Amazon Web Services (AWS) edge compute. This setup converts the vacuum into a data pipe for the cloud.

- Microsoft Azure Space: It orchestrates Luxembourg-based SES and SpaceX constellations through AI APIs. This integration incorporates orbital data into the existing enterprise AI stack.

- Palantir: Fuses satellite feeds into defense-grade decision platforms, translating capital and raw data into real-time battlefield inference.

The Chinese Command Stack (Unified Orchestration)

China’s response is centralized, command-based, and vertically synchronized.

- The Unified Engine: The China Aerospace Science and Technology Corporation (CASC) operates under a unified sovereign mandate. Huawei, CETC, and DeepSeek also operate under this mandate.

- The Guowang Initiative is China’s answer to Starlink. It is a planned 13,000-satellite constellation. It is designed as a single-state orbital stack. This stack fuses AI models, navigation (BeiDou), and defense telemetry.

- Vertical Integration: Unlike the U.S. model, where companies compete for contracts. China builds a coherent stack from the chip to the constellation. This approach ensures that AI doctrine is hard-coded into the hardware.

The U.S. codifies velocity through a bazaar of commercial nodes. China codifies control through a cathedral of command. Both sides now treat orbit as the physical substrate for “Inference at Altitude.”

The Strategic Comparison—The Stacked Ledger

While the U.S. leads in sheer volume and model supremacy, China’s strength lies in its ability to synchronize its infrastructure.

- U.S. Alliance Advantage: The U.S. can out-scale China through its alliance network (NASA, ESA, JAXA) and its dominant commercial players. Starlink already operates over 6,000 satellites, providing a massive, battle-tested head start in orbital liquidity.

- China’s Integration Edge: China counters with orchestration. The BeiDou navigation system has over 30 current-generation satellites. It offers 100% global coverage. The system is natively integrated into China’s maritime and industrial hardware.

- Developer Anchoring: The U.S. leads in “Developer Sovereignty.” By exporting APIs as infrastructure, firms like Microsoft and Amazon anchor the global developer class to Western rails.

AI-Native Orbital Logic—Inference at Altitude

The companies that command the 2026 cycle are those embedding AI inference directly into the orbital “rail.”

- On-Orbit Compute: The shift is from “Bent-Pipe” satellites (which merely relay data) to “Edge-Compute” satellites (which process data in orbit). This reduces latency and allows for real-time AI reasoning for autonomous systems and defense.

- Sovereign Cloud Expansion: Huawei Cloud and CETC are merging orbital imaging with DeepSeek’s reasoning models. They are offering “Sovereign Intelligence” to partners in the Global South.

- The API War: Microsoft and Amazon are striving to ensure compatibility for every satellite launched by an ally. These satellites must be “Azure-ready” or “AWS-native.” This locks the orbital layer into the U.S. software perimeter.

Orbital Diplomacy—The Global South as the Stage

Both superpowers are using orbit to export trust and dependency to emerging markets.

- China’s Infrastructure Diplomacy: Through the Belt and Road Initiative, China offers partners satellite internet, climate imaging, and dual-use communications. It is a “Space-as-a-Service” model designed to bypass Western terrestrial cables.

- The U.S. Soft Power Rail: The U.S. counters through corporate deployment. Starlink’s wartime utility in Ukraine demonstrates its strategic value. AWS’s humanitarian compute initiatives showcase its role in global efforts. These actions are rehearsals for a new era of “Digital Humanitarianism.” This era anchors nations to the U.S. commercial stack.

Conclusion

The orbital race is not a speculative vanity project; it is the construction of a permanent, high-altitude infrastructure.

In this choreography, the nation that anchors developers—not just satellites—will define the logic of space. The U.S. relies on the speed of its commercial giants. This velocity sets the standard. Meanwhile, China uses the integration of its command stack. This integration enforces its doctrine.

Further reading: