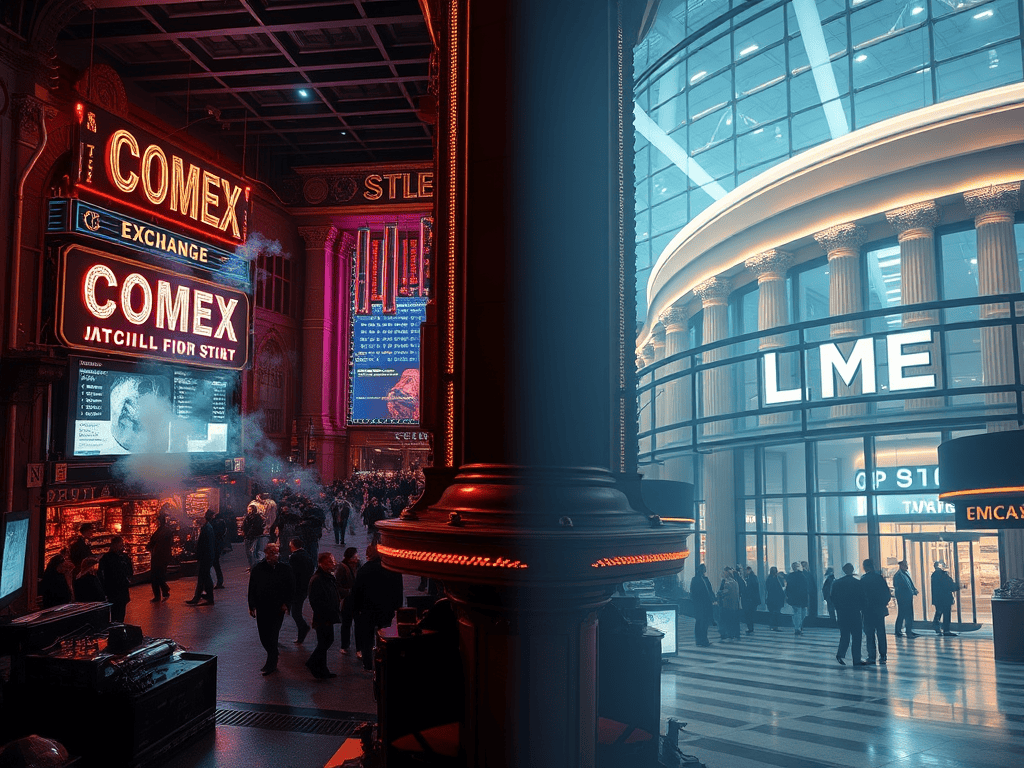

The United States imposed a 50% tariff on semi-finished copper imports. The immediate expectation was a reshuffling of domestic supply chains. Instead, the market performed a more profound, structural movement: a spontaneous migration of liquidity from the COMEX (a U.S.-centric rail) to the London Metal Exchange (LME).

This event validates a critical thesis. In a world of geopolitical friction, policy is no longer a policy tool. It is a stress test of platform predictability. Liquidity moves faster than legislation, abandoning any exchange infrastructure that embeds uncertainty.

Political Baggage Is the New Breach

The tariff did not simply raise costs; it contaminated the fundamental integrity of the futures contracts traded on COMEX.

The Fracture of Trust

- COMEX (The Fissured Rail): Contracts suddenly carried political baggage—embedded tariff risk, unexpected cost layers, and settlement ambiguity for industrial users. The unspoken question—”Can I exit cleanly?”—became conditional.

- LME (The Global Refuge): Contracts remained clear. The LME performed neutrality, maintaining its status as the global refuge for hedging and settlement.

Traders, hedgers, and manufacturers do not chase patriotism; they chase clarity. The exchange that choreographs clean, predictable settlement becomes the de facto issuer of market truth.

Platform Predictability Gains Market Authority

The COMEX to LME shift mirrors a financial migration we analyzed in the JPMorgan Treasury pivot. In that scenario, liquidity fled flexible Fed deposits. It sought the safety of sovereign debt. In both cases, the move was a search for the most reliable collateral and the most stable governance rail.

The Mechanism of Migration

- Loss of Authority: The tariff transformed COMEX into a U.S.-centric rail, sacrificing its global authority.

- Algorithmic Defection: Algorithmic desks immediately reweighted liquidity preference toward the LME. Structured products adjusted reference curves.

- Market Vote: This liquidity migration is the market’s instantaneous vote of no confidence in the domestic regulatory perimeter. The price of the contract became subordinate to the price of the political risk embedded in the exchange.

The Contagion Pattern Extends System-Wide

The copper migration is not isolated. The same choreography appears across other sectors where geopolitical optics contaminate the contract or the exchange.

Liquidity Migration Across Sectors

- Aluminum: Markets pressured by renewed U.S. sanctions shift their hedging preference toward the LME and the Shanghai Futures Exchange, seeking clear, non-contaminated pricing.

- Rare Earths: Traders experiment with Singapore and Dubai Over-The-Counter (OTC) desks. They also use early tokenized supply ledgers. These efforts help them escape national chokepoints and find verifiable provenance.

- Carbon Markets: U.S. political resistance to Europe’s Carbon Border Adjustment Mechanism (CBAM) is significant. This drives climate liquidity toward the EU Emissions Trading System (ETS) and on-chain carbon registries.

The pattern is structural: Tariffs fracture clarity. The market simply redraws its map around the cleanest path, migrating away from rails that carry political risk.

Conclusion

The future of global market infrastructure is not nation-native. It is platform-native. Copper revealed that: a tariff is no longer a simple policy tool. It is a stress test of belief.

The market doesn’t punish the tariff—it abandons the rail that carries it. COMEX performed friction. The LME performed neutrality. Liquidity performed its vote. This proves that platform predictability is the most valuable asset in a world defined by geopolitical uncertainty.

Further reading: