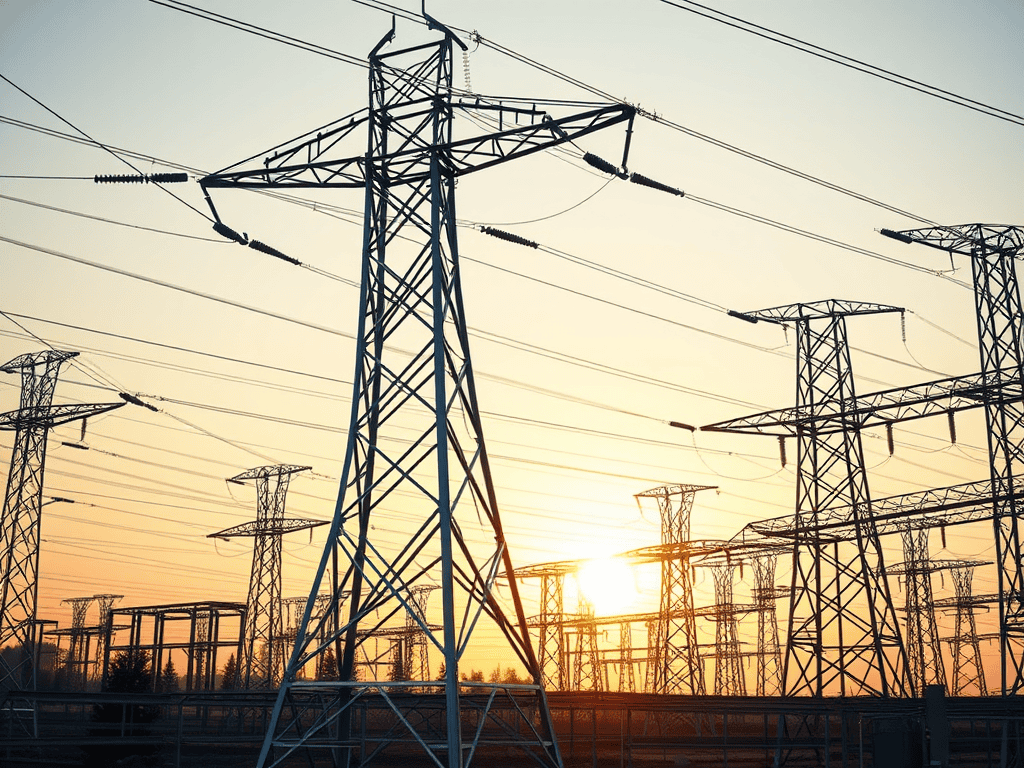

In 2025, aluminum performed a 14 percent price rally, signaling its evolution from a common industrial commodity into a systemic electrification metal. While metals like copper manage the “nerves” of the new economy—such as wiring and motors—aluminum has become the “spine.” It is the indispensable material for the high-voltage transmission lines that connect the world’s power plants to the rising campuses of Artificial Intelligence.

This rally is not merely a cyclical fluke; it is the result of a structural collision. Rapid grid expansion and the massive energy appetite of Artificial Intelligence are meeting a supply side that is strictly capped by energy policies and environmental restrictions, particularly in China.

The Primary Drivers: Grid Expansion and the AI Power Draw

Aluminum’s light weight and high conductivity make it the preferred material for long-distance power transmission. In 2025, two primary forces pushed demand beyond historical norms.

- The Global Grid Surge: National electrification programs are being driven by the integration of renewable energy and the expansion of Electric Vehicle charging networks. Together, they have boosted demand for high-capacity transmission lines.

- The AI Power Draw: Artificial Intelligence data centers are uniquely power-hungry. To feed “hyperscaler” campuses, utility providers are increasingly deploying aluminum conductors for high-voltage distribution. This “AI-to-Power” link has transformed aluminum from a construction material into a digital infrastructure asset.

- Capped Chinese Supply: China produces approximately 55 percent of the world’s aluminum. However, in 2025, strict energy consumption caps and environmental rules limited smelter output. Export quotas further tightened global flows, providing a resilient floor for international prices.

Aluminum is now the physical rail through which Artificial Intelligence consumes energy. While volatility persists, the demand from digital infrastructure has created a permanent structural bid for the metal.

The Demand Outlook: Moving from Resilience to Acceleration

The global aluminum market is shifting from a year of resilience in 2025 toward a period of acute structural tightness in 2026.

In 2025, demand growth remained steady at approximately 2 percent. This was sustained by the expansion of solar and wind energy, the continued adoption of Electric Vehicles, and the initial phase of the Artificial Intelligence build-out.

For 2026, demand is projected to accelerate to 3 percent. This stronger growth will be driven by aggressive grid expansion in emerging economies—specifically India, Southeast Asia, and the Middle East (Saudi Arabia and the United Arab Emirates). Additionally, United States and European infrastructure projects are expected to recover as trade policy volatility stabilizes.

The Supply Reality: A Structural Squeeze

Unlike the steel market, which struggles with a glut, the aluminum market is defined by structural tightness. Global primary aluminum output is expected to grow only 1 to 1.5 percent annually into 2026, consistently lagging behind demand.

The Bottleneck Ledger

- China’s Ceiling: With 55 percent of global supply under strict energy caps, Beijing’s ability to respond to price spikes is politically constrained. Export restrictions mean regional shortages are becoming more frequent.

- Marginal Producers: While regions like India and the Middle East are expanding capacity, these incremental gains are insufficient to offset the supply ceiling established by China.

- Smelting Energy Intensity: Aluminum production is among the most energy-intensive industrial processes. Rising global electricity prices have squeezed producer margins, discouraging the construction of new smelting capacity.

- The Green Transition Cost: The shift toward “Green Smelting”—using hydro-powered electricity—raises the capital requirements for new projects, further slowing the pace of expansion.

Aluminum faces a “Structural Squeeze.” Because supply growth cannot keep pace with demand, the market is entering a phase of chronic deficit that prevents prices from returning to pre-AI levels.

Price Momentum and the Investor Lens

Aluminum’s price now reflects the energy policies of the nations that produce it as much as it reflects industrial demand.

- Short-Term Signal: Prices remain elevated and volatile. The market is highly sensitive to energy cost shocks and changes in Chinese export quotas. Traders should expect reactive spikes whenever energy grids face winter or climate stress.

- Medium-Term Signal: Upward momentum is supported by the widening deficit projected for 2026. With demand growth tripling supply growth, the market is entering a phase of upside momentum that has not yet been fully priced into futures curves.

- Long-Term Signal: Aluminum is evolving into a structural bottleneck metal. Its role as the backbone of the electrification and Artificial Intelligence power layers ensures it will trade at a “scarcity premium” compared to traditional base metals.

Truth Cartographer readers should decode this as an “Electrification Bottleneck.” Aluminum has moved beyond its role as a cyclical commodity; it is now a strategic asset anchoring the global transition to a digital, electrified future.

Conclusion

Aluminum’s 14 percent rally is the first chapter of a larger structural shift. As the world builds the assembly lines of intelligence and the grids of renewable energy, aluminum will remain the primary physical constraint.

The systemic signal for 2026 is one of persistent tightness. Artificial Intelligence power needs provide the floor, while China’s energy caps provide the fuse.

Further reading: