In 2025, the steel market performed a surprising 27 percent price rally. The surge was driven by the massive physical requirements of the Artificial Intelligence revolution and aggressive global infrastructure programs.

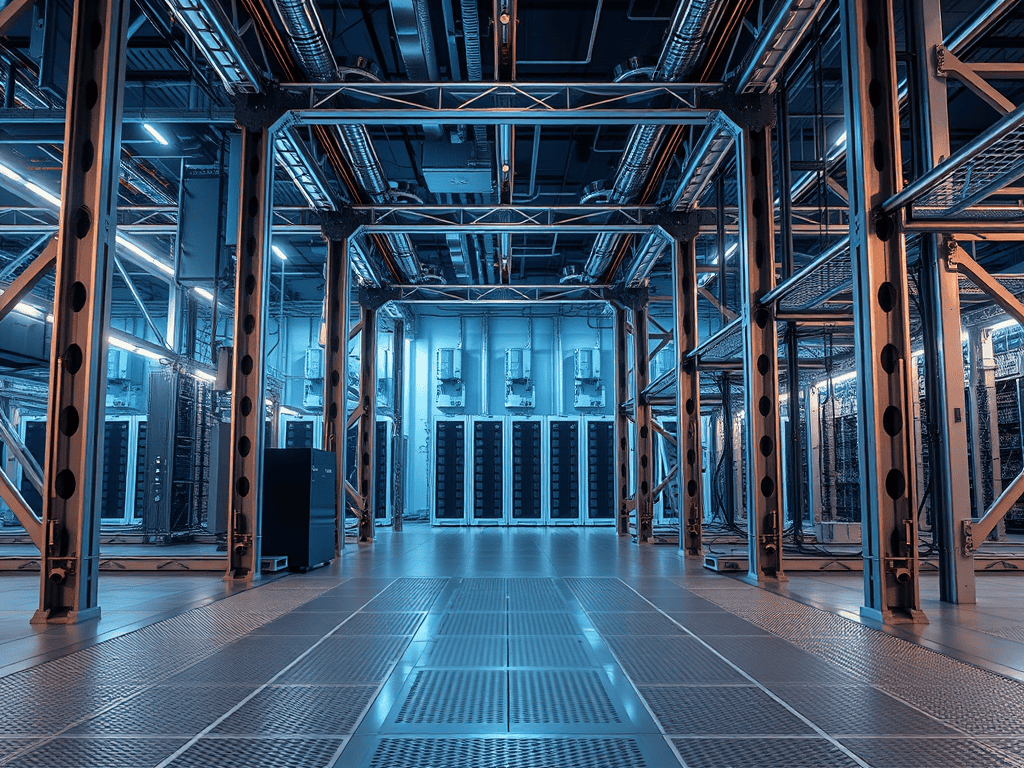

However, unlike the acute supply crunch seen in the copper market, steel faces a unique structural paradox: prices remain elevated despite persistent global overcapacity. The narrative for steel has shifted. It is no longer just a barometer for traditional construction; it has become the physical scaffolding of the digital age. From reinforced data center floors to massive cooling towers and server racks, steel is the indispensable hardware of the Artificial Intelligence era.

The AI Data Center Pivot: Turning Silicon into Steel

The primary driver of the current steel rally is the “Sovereign-Scale” build-out by “hyperscale” cloud providers such as Microsoft, Google, and Amazon.

- Artificial Intelligence Data Center Frames: These massive facilities require specialized steel for structural frames and reinforced flooring to support the immense weight of Graphics Processing Unit clusters.

- Cooling Towers: The thermal intensity of Artificial Intelligence computing demands high-grade steel for sophisticated cooling systems and water distribution infrastructure.

- Energy Infrastructure: Expanding the power grids and building the plants required to feed these data centers adds a secondary layer of intense steel demand.

Steel’s role has evolved from a cyclical industrial metal into the physical backbone of Artificial Intelligence. Every gigawatt of compute capacity added to the global map requires a corresponding tonnage of steel, locking the metal into a long-term growth narrative.

Policy Distortions: The Impact of Tariffs and Energy

Steel prices are currently disconnected from the underlying supply glut due to external friction points that act as a tax on the supply chain.

- The 50 Percent Tariff Wall: The United States administration’s 50 percent tariffs on steel imports have raised costs and disrupted global trade flows. This friction has created regional price imbalances, effectively masking global oversupply within the domestic market.

- Energy Intensity: Steelmaking remains highly energy-intensive. Rising electricity and coal prices in 2025 have squeezed producer margins, limiting supply growth even in regions with excess capacity.

- Decarbonization Pressure: The transition to “Green Steel”—low-carbon production—combined with new carbon taxes has added structural costs that prevent prices from falling to historical levels.

The 2025 rally is partially an optical effect of policy friction. While global supply is abundant, the 50 percent tariffs and high energy costs prevent that supply from dampening prices, creating a “volatility amplifier” for downstream industries.

The Demand Outlook: 2025 vs. 2026

The global steel demand landscape is shifting from a plateau in 2025 toward a modest rebound in 2026.

In 2025, global demand remained flat at approximately 1,749 million tonnes. This stagnation was driven by trade war uncertainty, tariff-induced volatility, and a slowdown in the Chinese property sector.

For 2026, demand is projected to rebound by 1.3 percent, reaching 1,773 million tonnes. This growth will be led by a long-awaited recovery in Europe and aggressive infrastructure expansion across the Global South—specifically in India, Vietnam, Egypt, and Saudi Arabia.

While 2025 was a year of plateau, 2026 signals a return to growth. The trajectory is no longer tied strictly to Chinese housing, but to urbanization in emerging markets and the American technology build-out.

The Supply Reality: Overcapacity vs. Crunch

Unlike the copper market, which faces a structural deficit, the steel market is defined by persistent overcapacity.

- Supply Growth: Global production is rising at 1 to 2 percent annually, consistently outpacing the modest demand rebound.

- The China Factor: China continues to overproduce, flooding international markets with excess supply. This creates a latent drag on prices that only tariffs and trade barriers are currently holding back.

- Emerging Competition: While nations like India and Vietnam are expanding their domestic steel capacity, it is not yet enough to offset the massive oversupply anchored in China.

Steel faces a “Latent Glut.” Supply growth continues to outpace demand, creating a mismatch that keeps margins thin despite high headline prices.

Price Momentum and the Investor Lens

Steel’s price momentum is a result of the collision between infrastructure demand and policy-driven cost increases.

- Short-Term Signal: Prices remain elevated and volatile. The market is pricing the “spectacle” of tariffs and the immediate needs of Artificial Intelligence build-outs while largely ignoring the underlying oversupply.

- Medium-Term Signal: As demand rebounds in 2026, global overcapacity will likely cap any further aggressive rallies. Investors should expect stabilized but “capped” pricing.

- Long-Term Signal: Steel remains a systemic metal, but it will face a permanent margin squeeze. The cost of the green steel transition and the reality of China’s capacity will eventually force a structural consolidation in the industry.

Truth Cartographer readers should decode this as a “Capped Rally.” Steel is the physical backbone of the new era, but the existence of a global glut means upside potential is limited compared to “bottleneck” commodities like copper or silver.

Conclusion

Steel’s 27 percent rally is the market’s response to the physical scaling of Artificial Intelligence, but the structural foundations of the metal remain under pressure.

The systemic signal for 2026 is one of stabilization under a “ceiling.” Artificial Intelligence build-outs provide the floor, while global overcapacity provides the roof. For the investor, the key is recognizing that steel is an infrastructure trade, not a scarcity trade. The supply is waiting just outside the tariff wall.

Further reading: