The latest earnings from the giants of the Artificial Intelligence (AI) race reveal a profound structural paradox. Both Meta and Alphabet are spending at an industrial scale. However, they operate under two fundamentally different architectures of time.

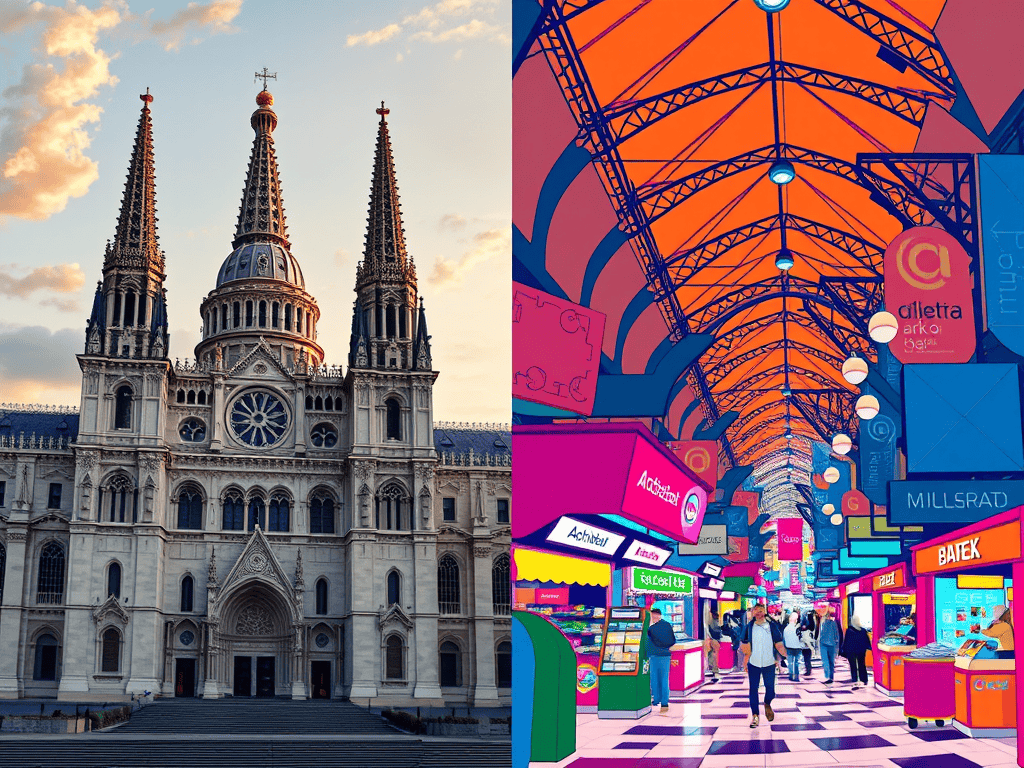

Meta is building a “Cathedral”—a sovereign, self‑contained monument to durable infrastructure. Alphabet is building a “Bazaar”—a distributed, fluid conduit for real‑time monetization. AI models evolve faster than hardware depreciates in this economic regime. The market is no longer pricing scale. Instead, it is pricing temporal discipline. Welcome to the Half‑Life Economy.

Meta’s Monument to Durable Time

Meta’s latest earnings confirmed the staggering cost of manufacturing belief. The company expects to spend $70–72 billion in 2025 on Capital Expenditure (CapEx), nearly 70% higher than its 2024 outlay. Long‑term, Meta projects over $600 billion in infrastructure investment by 2028.

The Ambition and the Paradox

Nearly all of this spending is concentrated in U.S.‑based AI compute: custom silicon, massive GPU clusters, and power‑hungry data centers. The optics are visionary, but the structure is paradoxical. Meta is rehearsing durable infrastructure inside a regime where time itself is decaying.

By building for a ten‑year horizon, Meta assumes that tomorrow’s assets will survive today’s iteration cycle. However, in the Half‑Life Economy, infrastructure now ages faster than its yield curve.

Alphabet’s Monetized Velocity

Alphabet’s 2025 CapEx was even larger — forecasted at $85–93 billion — but it diverges sharply in its architecture. Alphabet doesn’t build monuments; it builds conduits.

The Modular Advantage

Alphabet treats time as modular. Its spending is designed to refresh continuously and monetize each iteration immediately:

- CapEx Refresh Cycles: Tied directly to Gemini model upgrades, ensuring hardware stays relevant to the software it runs.

- Optimized Data Centers: Built for latency and immediate revenue extraction rather than long‑horizon speculation.

- Immediate Revenue Loops: AI pipelines feed real‑time earnings across Search, Cloud, and YouTube.

- Strategic Collaborations: Roughly 10% of its AI CapEx ($8–10 billion) flows into partnerships with OpenAI and Anthropic. Investments are also made in strategic data centers to augment current revenue.

Alphabet doesn’t fight time; it rents it. By embedding AI liquidity directly into profit engines, it ensures there are no stranded assets — only refreshed conduits.

The Half‑Life Economy — When Assets Age Faster Than Returns

The fundamental industrial rhythm of multi‑year amortization is broken. In the AI sector, a new model leads to a new chip. This development demands a new memory layout. It also requires new infrastructure. CapEx no longer buys permanence; it buys decay.

Time as a Risk Vector

This is the essence of the Half‑Life Economy: assets that depreciate before they deliver.

- The Obsolescence Trap: By the time a firm finishes a cluster for Llama 3, a new demand arises. Llama 4 requires a different physical and thermal layout.

- Relic Creation: A server rack becomes a relic before it returns its cost.

- The Speculation Mismatch: Meta’s ambition assumes that controlling infrastructure equals controlling destiny. But when innovation velocity exceeds the fiscal cycle, “control” becomes a temporal illusion.

Meta compounds CapEx into obsolescence risk, while Alphabet compounds progress into earnings each cycle. The new logic of viability is simple: you must earn before the hardware expires.

Market Repricing as Temporal Discipline

Markets price these time regimes intuitively. Following their respective earnings reports, Meta’s valuation fell nearly 8% (≈$155 billion erased), while Alphabet’s valuation rose roughly 7% (≈$200 billion added).

These were not mere mood swings; they were temporal repricings. The market is rewarding firms that assimilate obsolescence and disciplining those that resist it.

Comparing the Time Signatures

The difference between Meta and Alphabet is not found in the sheer magnitude of their spending, but in the temporality of their strategies:

- Meta (The Cathedral): Meta allocates roughly 35–38% of revenue to CapEx, with a decade‑long horizon. Its assets age faster than its yield curve, creating a paradox of durability in a fast‑decaying cycle. Meta’s infrastructure is sacred but slow — a monument to long‑term belief.

- Alphabet (The Bazaar): Alphabet allocates about 30–32% of revenue to CapEx, but with a two‑to‑three‑year refresh horizon. Its assets evolve in step with its revenue streams, ensuring adaptability. Alphabet’s infrastructure is secular and fast — a bazaar of conduits that refresh continuously.

Meta builds cathedrals that take decades to complete, betting that their permanence will secure sovereignty. Alphabet builds bazaars that refresh stalls every season, ensuring each cycle generates immediate returns.

Conclusion

Meta’s fall and Alphabet’s rise are expressions of the same temporal collapse. The cathedral and the bazaar are no longer metaphors; they are the time signatures of the AI era.

To navigate this landscape, investors and policymakers must adopt a new audit protocol:

- Audit the Time Regime: Is the capital being used to build a monument or a conduit?

- Velocity vs. Monetization: Recognize that velocity without monetization is structural fragility.

- Infrastructure Adaptability: Infrastructure that cannot refresh becomes symbolic. Capital that cannot adapt becomes a relic.

Meta’s massive ambition may pay off someday, but only if the pace of time slows down. In the world of AI, time never slows — it accelerates. In the Half‑Life Economy, the only durable asset is the ability to monetize the temporary.