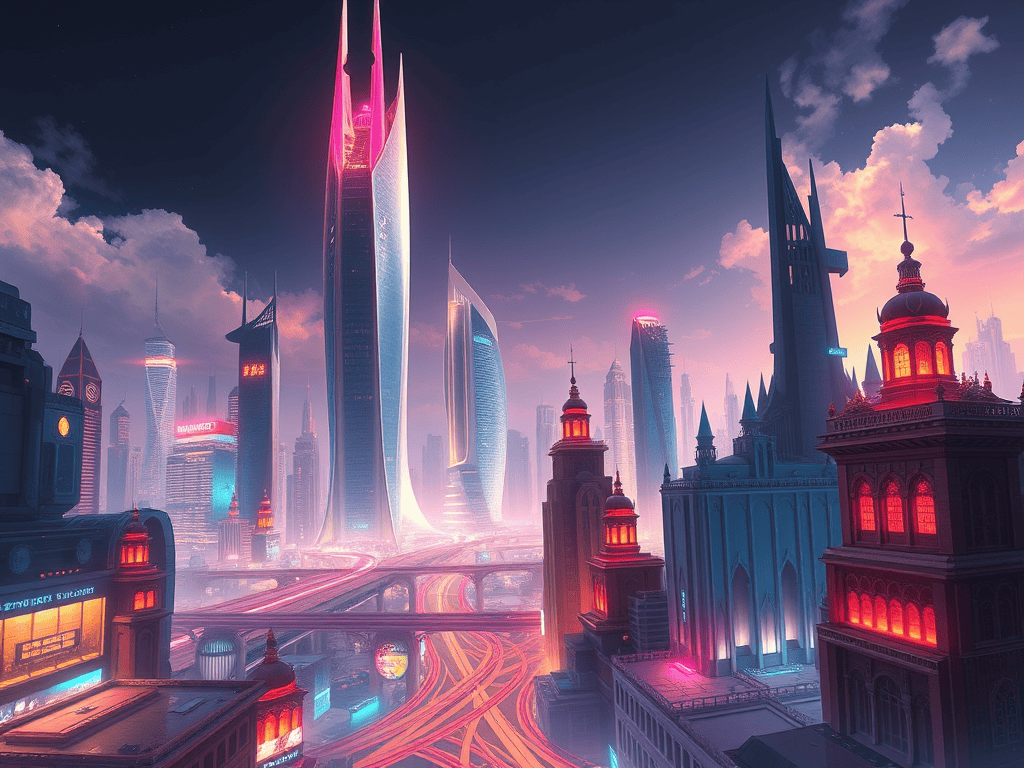

Ethereum was once the undisputed capital of crypto modernity. It still stands, but its energy has fundamentally shifted. In 2025, the energy of the main city feels ceremonial instead of insurgent. Transaction fees rise and traffic thickens. Innovation increasingly feels like a rehearsal for preservation. It is not a drive for transformation.

Out of this stagnation came MegaETH—a parallel city built for speed. With near-instant finality and near-zero latency, MegaETH raised more than $500 million in its 2025 launch phase. But the most significant factor is not the capital or the code—it is the choreography of its endorsement.

Choreography—The Ritual of Succession

Ethereum’s founders, Vitalik Buterin and Joe Lubin, have performed something rare in the history of technological governance. They have sanctioned their own successor. By serving as strategic advisers to the MegaETH foundation, they are not resisting the fork; they are authorizing it.

This is the choreography of dynastic transition:

- The Archive and the Performance: Ethereum becomes the archive—the secure, historical bedrock of the ecosystem. MegaETH becomes the performance—the high-velocity marketplace where the next cycle of innovation occurs.

- Codified Legitimacy: The founders are not merely backing a project. They are blessing a faster, leaner heir to the Ethereum legacy. This effectively forks the basis of trust itself.

MegaETH is the “shadow city” that the founders built to escape the constraints of their own success. By authorizing the transition, they are moving legitimacy from the original architecture to the new choreography.

Fragmentation—The Split of Belief

The arrival of MegaETH fractures Ethereum’s once-unified consensus base. Developers are migrating for speed. Investors are chasing yield. Influencers are rewriting the mythos of what a “sovereign chain” should be. The result is a profound divergence in belief jurisdictions.

- The Museum: Ethereum appeals to history, institutional stability, and long-term security. It is the capital city for those who prioritize preservation.

- The Marketplace: MegaETH trades in velocity, optics, and immediate utility. It is the destination for those who demand real-time performance.

Symbolic Velocity—The Founders’ Motive

While the technical case for MegaETH (latency and throughput) is strong, the deeper motive is symbolic. After observing rival ecosystems—like Solana—absorb cultural and financial momentum, Ethereum’s founders have pivoted. They are no longer defending the past; they are curating the future.

MegaETH’s oversubscribed launch proves the efficacy of this strategy:

- Founder Blessing + Speed Narrative + Ethereum Heritage = Synthetic Legitimacy.

This formula allows MegaETH to bypass the years of community-building usually required for a new chain. It inherits the gravity of the “Ethereum” brand. At the same time, it sheds its technical inertia.

The Regulatory Vacuum—The Sovereignty Gap

MegaETH provides a frictionless experience for users, but it creates a structural “Sovereignty Gap.” With every new protocol, sovereignty fragments. Wallets multiply, bridges fracture, and institutional oversight evaporates into the sheer complexity of the multi-chain environment.

Regulation trails far behind this choreography:

- The SEC Blind Spot: The U.S. Securities and Exchange Commission (SEC) currently has no framework for successor chains or founder-backed forks.

- The MiCA Gap: The European Union’s Markets in Crypto-Assets Regulation (MiCA) covers token issuance but lacks clarity on narrative-minted legitimacy.

- The Collapse of Verification: Verification has collapsed outward. There is no central jurisdiction governing the “truth” of a protocol’s blessing. Citizens are now their own regulators.

The citizen must now become a Navigator. To survive this era, one must learn to chart a world where legitimacy forks as quickly as the code itself.

Conclusion

To navigate this “City and its Shadow,” the citizen-investor must adopt a new audit protocol:

- Audit Choreography, Not Just Code: Ask what narrative is being rehearsed. Does legitimacy live in the consensus of the network, or in the celebrity of the advisors?

- Diversify Across Sovereign Layers: Treat Ethereum, Bitcoin, and MegaETH as separate belief jurisdictions. Interoperability is an optic; true unity is a myth.

- Codify Personal Sovereignty: Engage directly with the infrastructure. Test the wallets. Use the bridges. Sovereignty is no longer a status granted by the state—it is a practice maintained by the user.

- Watch the Regulatory Choreography: Oversight will target optics, not code. It will arrive late and be shaped by the next crisis rather than by proactive design.

The question for every digital citizen is no longer “Will crypto replace the state?” but rather “Which ledger will I choose to believe?” In the succession of MegaETH, the founders have shown that the future belongs to visionary city planners. They can choreograph the most compelling city. The stage is live, the city is split, and the choice of ledger is yours.

Further reading: