Summary

- China suppresses private stablecoins: Only state‑issued e‑CNY may perform redemption.

- U.S. enables regulated stablecoins: GENIUS Act backs tokens with Treasuries under federal oversight.

- Private‑public choreography: Ventures like USD1 align private rails with sovereign optics.

- Two models, one goal: China centralizes, U.S. federates—both seek to preserve monetary gravity.

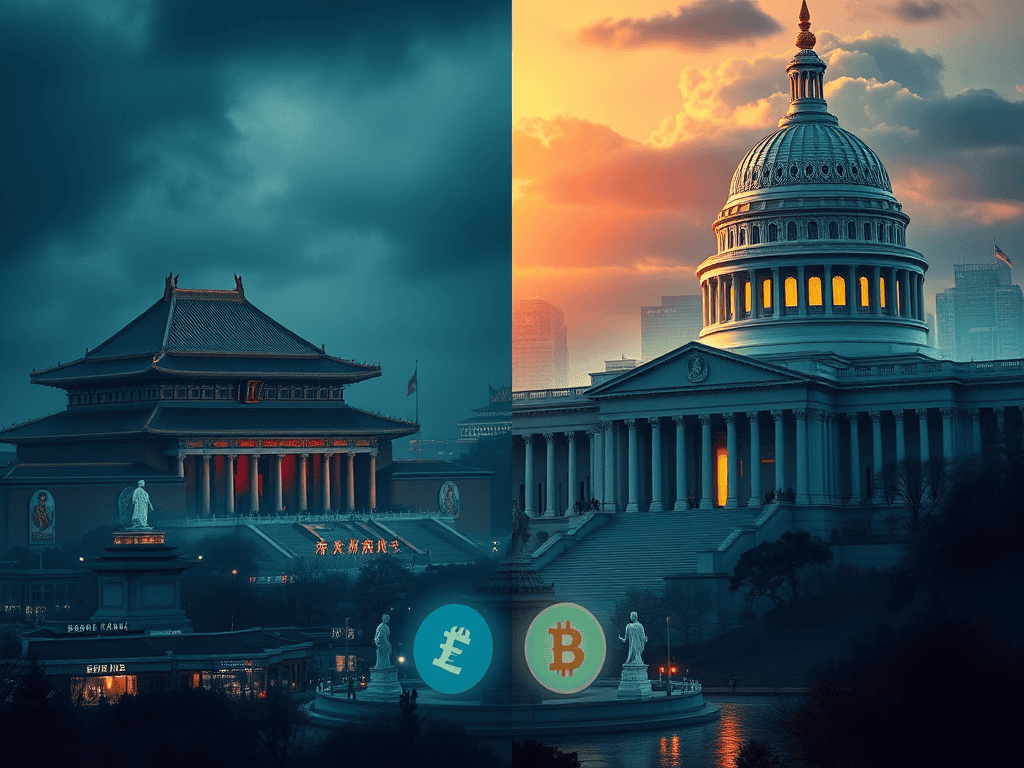

Two Empires, One Silent War for Redemption

By late 2025, the world’s two largest economies moved in opposite directions on digital money.

- Beijing halted stablecoin initiatives by Hong Kong’s biggest tech firms, signaling that only state‑issued currency may perform redemption.

- Washington passed the GENIUS Act (July 2025), opening the door for federally supervised payment stablecoins backed by U.S. Treasuries.

This divergence isn’t policy drift—it’s monetary strategy.

Beijing’s Model: Sovereignty Through Exclusion

On 19 October 2025, the People’s Bank of China and the Cyberspace Administration of China ordered Ant Group and JD.com to suspend participation in Hong Kong’s stablecoin licensing regime.

Officially, the halt was precautionary. In practice, it reasserted Beijing’s monopoly on monetary legitimacy. The e‑CNY remains China’s programmable core; private tokens are denied entry. Suppression isn’t fear—it’s insulation. Redemption, settlement, and monetary choreography stay centralized.

Washington’s Model: Sovereignty Through Enablement

The GENIUS Act doesn’t just legalize stablecoins—it canonizes them.

- Issuers must back tokens with dollars or short‑term Treasuries.

- Monthly disclosures are required.

- Federal oversight ensures compliance.

Treasury’s rule‑making process (October 2025) shows Washington wants to shape, not suppress, digital money. Stablecoins become programmable extensions of the dollar, embedding U.S. monetary supremacy into new rails. Redemption backed by Treasuries is not just finance—it’s a public performance of trust.

Private Stake, Public Optics

The GENIUS Act’s framework for “permitted payment stablecoin issuers” creates a new battlefield.

- Ventures like USD1 and World Liberty Financial position themselves as “America’s sovereign stablecoin.”

- Private rails align with executive‑branch optics.

- State policy sets the perimeter; private issuers perform redemption.

Governance merges with infrastructure; optics merge with authority.

Two Sovereign Models, Two Exposures

- China’s model consolidates control by excluding private issuers.

- The U.S. model distributes monetary choreography across licensed entities.

One centralizes; the other federates. One constrains innovation; the other weaponizes it. Both aim to preserve monetary gravity in a world where digital rails threaten to loosen it. The divergence is architectural, not ideological.

Conclusion

China rehearses control—restricting issuance, sealing borders, guarding the yuan’s perimeter. The United States rehearses belief—opening token corridors, embedding redemption in Treasuries, exporting the dollar through programmable rails.

One model tightens the map; the other expands it. The battlefield isn’t currency supply or blockchain adoption—it’s redemption choreography: who may mint, who may redeem, and whose ledger becomes the stage for global transactions.