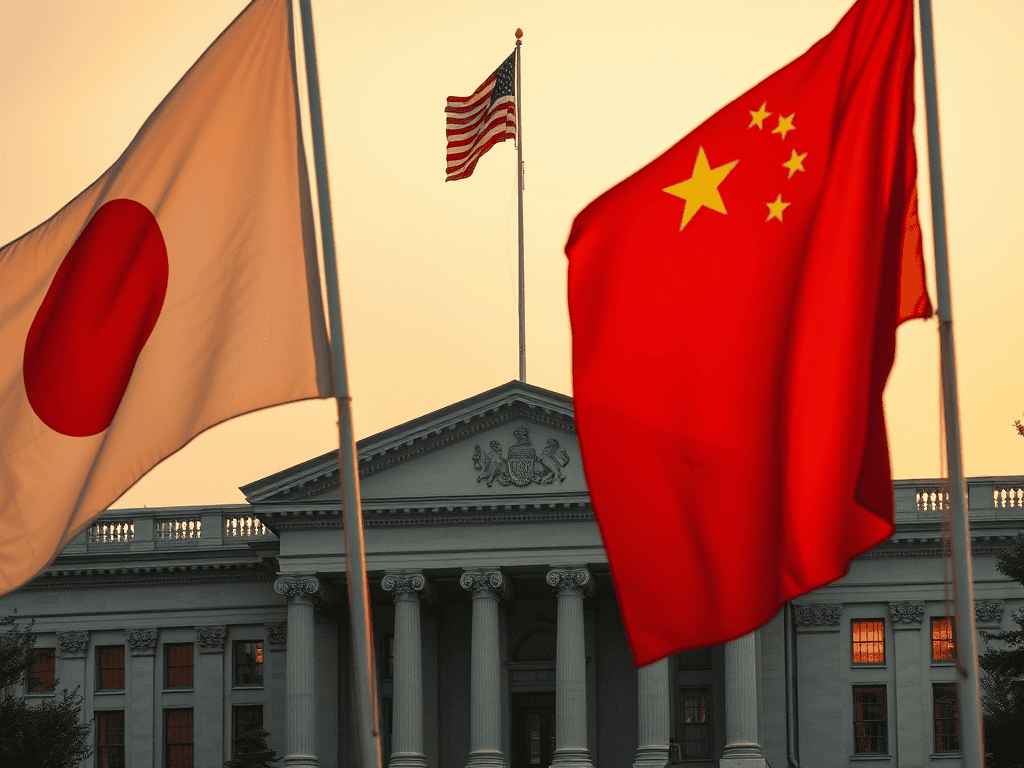

Two nations mirroring each other.

Argentina’s peso crisis and the United States (U.S.) debt spiral are not opposites. They are mirrors—two nations rehearsing solvency through optics while structural integrity decays. The citizen becomes both participant and audience. They navigate a monetary system that remains coherent only as long as its symbols hold.

The Two Scripts of Solvency Performance

The modern crisis is defined by a gap between sovereign financial mechanics and public optics. Argentina and the U.S. are merely executing different scripts on the same stage.

Argentina’s Story (External Choreography)

Ahead of midterms, Argentina secures a $40 Billion U.S.-backed International Monetary Fund (IMF) lifeline. President Milei announces reform and stages liberalization.

- The Reality: Foreign Exchange (FX) controls persist. Inflation breaches 140%. The peso sinks toward 1477 per U.S. dollar.

- The Performance: Argentina performs solvency through emergency foreign liquidity and the promise of structural reform—a script contingent on external trust.

The U.S.’s Story (Internal Choreography)

The U.S. now carries $38 Trillion in gross national debt—roughly 125% of Gross Domestic Product (GDP). The 2025 deficit approaches $1.78 Trillion. Interest payments alone rival defense spending.

- The Reality: The dollar remains stable not because of a surplus. It is stable because reserve currency privilege performs solvency long after the balance sheet breaks.

- The Performance: The U.S. stages solvency through reserve supremacy. It also defers consequences behind the optics of stability. This script is contingent on global status.

Reserve Currency as Redemption Theater

The dollar’s global role is a symbolic privilege, not a structural guarantee. It allows the U.S. to borrow without immediate punishment and defers consequence behind the illusion of stability.

- The Privilege Erosion: This privilege frays as interest costs surpass $1 Trillion and foreign buyers retreat from U.S. Treasuries.

- The Narrative Anchor: The choreography includes legislative negotiations, central bank press conferences, and the persistent global need for dollars. These elements sustain the narrative, even as the fiscal reality decays.

Fiscal Optics vs. Structural Repair

Sovereign action is consistently focused on optics—short-term political cover—while the structural drivers of debt remain unaddressed.

- Optical Fixes: Tariff revenue and tax narratives offer political cover.

- Unaddressed Drivers: Entitlements, military budgets, and compounding interest—the true structural drivers—remain unaddressed.

Conclusion

The citizen cannot exit the system—but they can decode it.

Further reading: