Summary

- Dot‑com was horizontal and fragile; AI is vertical and concentrated.

- The Magnificent Seven anchor the boom with real cash flow.

- Smaller AI firms may collapse, but mega‑cap earnings act as shock absorbers.

- A correction is inevitable, but a total crash is unlikely.

From Dot‑Com Collapse to AI Containment

In 2000, the dot‑com frenzy imagined an internet‑integrated future — and ended with an 80% Nasdaq crash. In 2025, the AI boom promises cognition at scale. Commentators often replay the ghost of 2000, warning of another bubble.

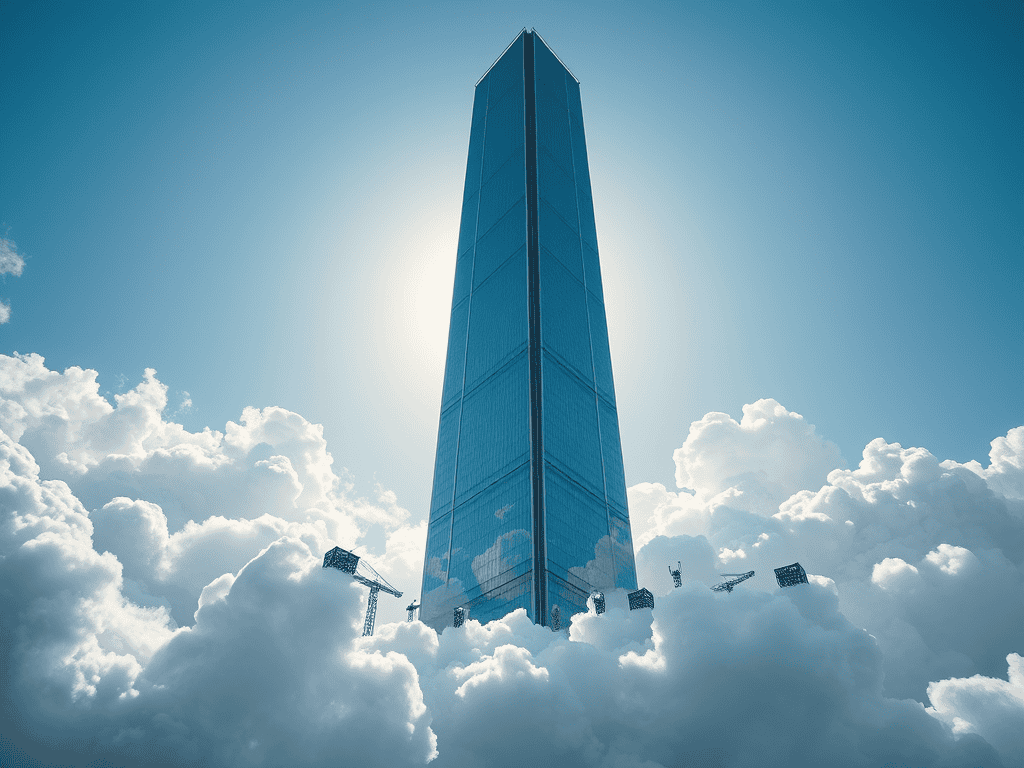

But the structure beneath today’s rally is fundamentally different. The dot‑com bubble was horizontal — thousands of fragile startups burning cash. The AI surge is vertical — anchored by the Magnificent Seven (Nvidia, Microsoft, Alphabet, Amazon, Apple, Meta, Tesla). The real question isn’t whether speculation exists, but whether it can breach the core layer holding the market together.

Why the AI Economy Is Different

- Dot‑Com Era: Startups were priced on clicks and page views. When the illusion cracked, there was no balance‑sheet core to absorb the shock.

- AI Era: Today’s economy is concentrated in mega‑caps with massive cash flow, hardware dominance, and clear monetization.

Key Point: The dot‑com bubble was a carnival of fragile players. The AI boom is a cathedral of giants. Even if smaller firms collapse, the core remains standing.

The Architecture of the AI Stack

The AI economy is a synchronized system where every layer is monetized:

- Compute Core: Nvidia supplies the chips and CUDA lock‑in.

- Cloud Rail: Microsoft and Amazon run the infrastructure where models are trained.

- Data Pipe: Alphabet owns the datasets for next‑gen reasoning.

- Device Edge: Apple and Meta control the human interface — phones, glasses, social platforms.

- Mobility Loop: Tesla fuses compute with physical autonomy.

This depth provides a “redemption logic” that the 2000 era lacked.

Tower vs. Periphery

Around the central tower sits the symbolic economy — smaller AI firms priced on hype rather than cash flow. They replay the dot‑com script.

But today, a collapse in the periphery doesn’t guarantee a systemic reset:

- Shock Absorbers: ETFs and mega‑cap buybacks cushion volatility.

- Buffer: The Magnificent Seven’s earnings provide liquidity to keep the market intact.

The Investor’s Codex

To navigate this landscape, investors should audit structure, not sentiment:

- Separate Core vs. Narrative: Distinguish infrastructure giants from speculative small‑caps.

- Track Containment Capacity: Watch how much volatility mega‑cap earnings can absorb.

- Prioritize Durable Revenue: Favor firms with recurring, high‑margin profits.

- Accept Duality: The AI boom is both risky and resilient — danger and durability fused together.

Conclusion

A correction in AI markets is likely. But a 2000‑style collapse is structurally improbable. The vertical containment of 2025 ensures the digital economy’s core is resilient. It is designed to survive the implosion of its own hype.

Further reading: