Summary

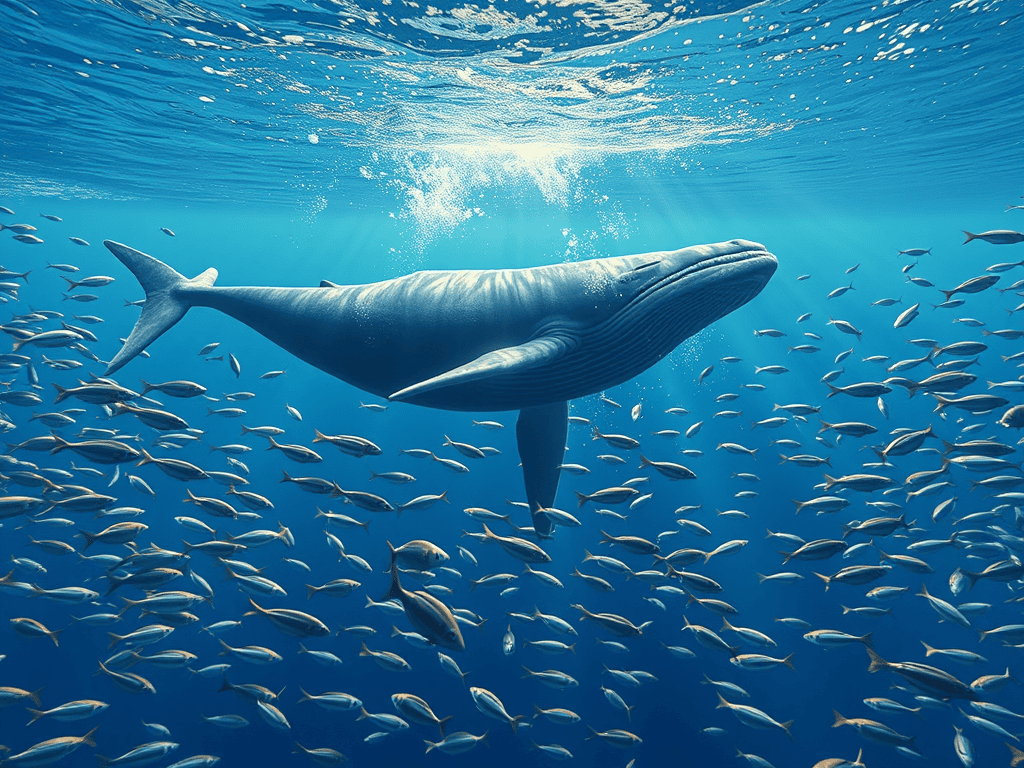

- Whales closing leveraged positions is not an exit — it’s a move away from fragile risk into long-term ownership.

- A classic market pattern (“Wyckoff Spring”) is flushing fearful sellers before a rebound.

- Rising stablecoin balances signal capital waiting to re-enter, not leaving crypto.

- As excess debt is cleared, the market shifts from hype-driven moves to institutionally supported scarcity.

A Market Misread

At first glance, recent data looks alarming. Large holders — often called “whales” — have been closing leveraged long positions. To many retail traders, this signals retreat. Social media interprets it as distribution. Fear spreads quickly.

But the ledger tells a different story.

What’s happening is not capital leaving crypto. It’s capital changing how it stays invested.

Leverage magnifies gains, but it also magnifies risk. In unstable periods, professional investors reduce exposure to forced liquidations and move toward direct ownership. This shift — from borrowed exposure to outright ownership — is known as a liquidity reset.

In simple terms: the market is being cleaned, not abandoned.

The Deception of the “Exit”

Exchange data shows whales reducing leveraged positions after a peak near 73,000 BTC. That looks like an exit only if you assume leverage equals conviction.

It doesn’t.

Leveraged positions are best understood as temporary bets funded with borrowed money. They are vulnerable to sudden price swings and forced closures — a dynamic we previously audited in Understanding Bitcoin’s December 2025 Flash Crash.

When conditions become unstable, sophisticated capital doesn’t leave the market. It leaves fragile structures.

That distinction is critical.

On January 9, 2026, a single institutional whale deployed roughly $328 million across BTC, ETH, SOL, and XRP. That capital didn’t disappear — it was reallocated.

The shift is structural:

- Out of the Casino — leveraged perpetual contracts

- Into the Vault — spot holdings and on-chain ownership

This allows institutions to remain exposed to upside without the risk of forced liquidation.

Forensic Deep Dive: The Wyckoff “Spring” Trap

The Wyckoff “Spring” is one of the oldest and most effective market traps.

It occurs near the end of an accumulation phase and is designed to do one thing: force nervous sellers out before prices rise.

The mechanism is simple. Price briefly drops below a level everyone believes is safe — for example, falling to $95,000 when $100,000 was widely seen as the floor. Stop-losses trigger. Panic selling accelerates.

That panic creates liquidity.

Institutions use the sudden surge of sell orders to quietly accumulate large spot positions at discounted prices. Once selling pressure is exhausted, price quickly snaps back above support.

Historically, this snap-back phase often marks the beginning of the fastest rallies — not because sentiment improved, but because ownership shifted from emotional sellers to patient buyers.

A bullish Spring leaves a clear footprint:

- Heavy volume during the dip

- A rapid reclaim of support

- Stablecoins rising relative to Bitcoin, signaling ready capital

A true breakdown looks very different: price stays weak, and capital leaves the system entirely.

That’s not what the ledger shows today.

The “Dry Powder” Signal: Stablecoin Reserves

The most telling signal right now is the rising stablecoin-to-Bitcoin ratio.

When whales exit leverage, they aren’t cashing out to banks. They’re parking capital in stablecoins — assets designed to hold value while remaining fully inside the crypto ecosystem.

This is what investors call dry powder.

Stablecoins allow institutions to wait, observe, and re-enter markets instantly when conditions turn favorable. It’s a sign of patience, not fear.

This behavior is being reinforced by broader macro conditions. As volatility in traditional markets declines, institutional appetite for risk rises. When fear subsides, capital looks for opportunity — and crypto remains one of the highest-beta destinations.

We mapped this spillover dynamic earlier in Why Crypto Slips While U.S. Stocks Soar.

The takeaway is straightforward: capital hasn’t left crypto — it’s waiting.

Conclusion

What many are calling a “whale exit” is actually a market hygiene event.

By clearing roughly 73,000 BTC worth of leveraged exposure, the market has removed its most dangerous pressure points — the debt tripwires that turn normal volatility into violent crashes.

The structure is changing.

Crypto is moving away from a phase dominated by leverage, hype, and reflexive trading. In its place, a quieter and more durable force is emerging: institutional spot accumulation and engineered scarcity.

The Wyckoff Spring is the final deception in this transition. It is the moment the market tells its last convincing lie — just before the truth asserts itself.

That truth is simple:

- Ownership is replacing leverage

- Liquidity is consolidating, not leaving

- The next rally will be built on scarcity, not speculation

Those who mistake cleanup for collapse will stay sidelined.

Those who audit the ledger will recognize what’s really happening: the foundation is being laid.

Further reading: