Summary

- Treasuries offer little reward, eroding their safe‑haven appeal.

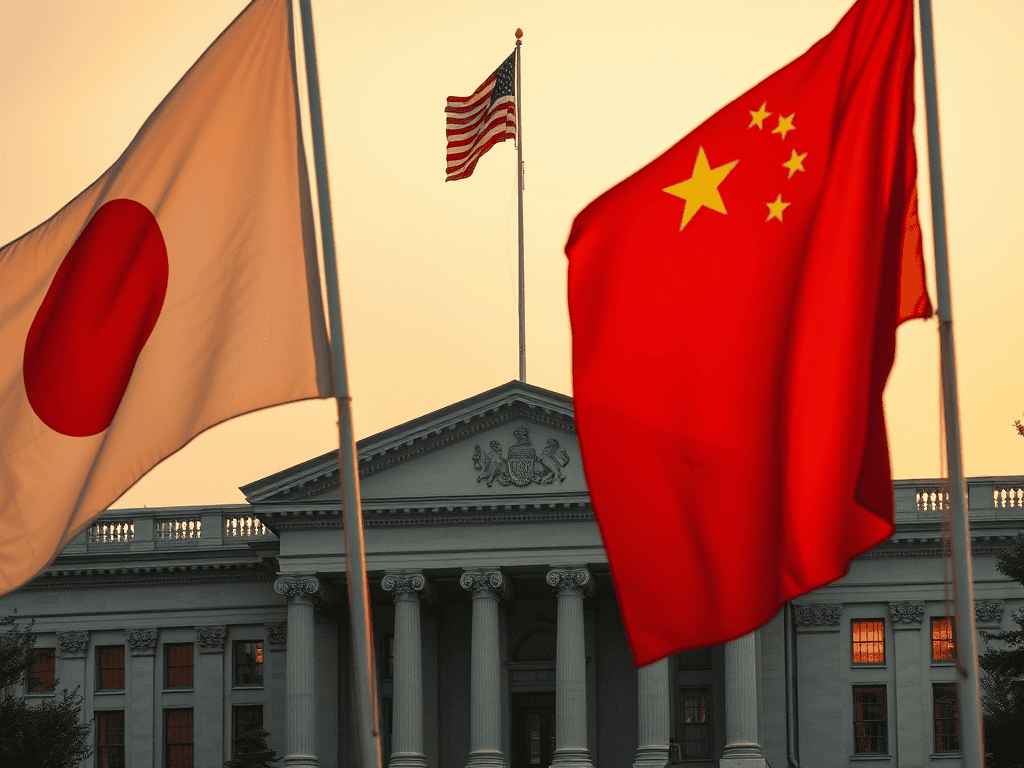

- Japan is redirecting capital into domestic projects, cutting U.S. holdings at record pace.

- China is engineering yuan‑based trade and gold accumulation to reduce dollar reliance.

- Investors are reallocating into gold, infrastructure, and regional debt markets.

The U.S. Treasury Was Once the Center of Gravity

For decades, U.S. Treasuries were the safest place for global capital — the “planetary core” of finance. Nations parked their reserves in American debt because it offered yield, stability, and dollar supremacy. But by 2025, that gravitational pull is weakening.

Yield Compression Isn’t Stability — It’s a Warning

- The 10‑year Treasury yield sits near 4.35%.

- With inflation around 3.2%, the real return is only 1.1%.

For long‑term holders like Japan and China, U.S. debt no longer looks like a strategy. It looks like exposure. Investors aren’t worried about default — they’re worried about stagnation. When returns shrink, conviction migrates. Markets don’t abandon safety; they abandon diminishing returns disguised as safety.

Why it matters: Thin real yields make Treasuries less attractive, eroding their role as the world’s “safe haven.”

Japan Is Redirecting Capital

Japan’s retreat is deliberate. After years of subdued currency policy, a new Prime Minister is reviving an Abenomics‑style push to boost domestic demand.

- In Q2 2025, Japan cut $119 billion in U.S. holdings — the sharpest quarterly reduction ever.

- Washington’s request for Japan to fund $550 billion in U.S. infrastructure without decisive control accelerated the pivot.

This isn’t rebellion. It’s realignment. Japan is weakening the yen, strengthening home investment, and reclaiming autonomy. Sovereign governments don’t need to announce such moves — they reallocate quietly.

Why it matters: Japan is showing that even close allies will prioritize domestic growth over U.S. debt dependence.

China Is Engineering a New Monetary Map

China’s U.S. debt holdings have fallen below $760 billion, down more than 40% from their 2015 peak.

This is not panic selling. It’s de‑dollarization by design:

- Expanding yuan‑settled trade.

- Accelerating gold accumulation.

- Building bilateral payment rails across Asia, Africa, and the Gulf.

The People’s Bank of China doesn’t need to declare a gold standard. Citizens are already stacking gold bars, reinforcing state policy through conviction.

Why it matters: China is quietly building alternatives to dollar dominance, reshaping global trade flows.

Capital Is Rotating — Quietly but Decisively

- Over $150 billion has flowed out of U.S. growth funds in 2025.

- Real yields are thin, deficits are widening, and the assumption of infinite demand for U.S. debt is fracturing.

Capital isn’t fleeing in panic. It’s drifting toward other “gravity wells”:

- Gold

- Domestic infrastructure

- Regional debt markets

- Politically aligned trade corridors

Why it matters: The retreat is gradual but structural — a rebalancing of global capital away from U.S. dependence

Conclusion

The myth of endless appetite for U.S. debt has expired. Japan and China aren’t staging a rebellion; they’re writing a new choreography.

The Treasury market still anchors global finance, but belief is quietly finding new orbits. Sovereigns are reallocating, investors are diversifying, and the world is stepping back from an overburdened fiscal core.

Further reading: